The super app has emerged in the East and has been taking over as consumers thrive on the convenience of having all their needs addressed in one place. But what exactly is a super app, and should traditional financial services be worried about third-party entities encroaching on your space?

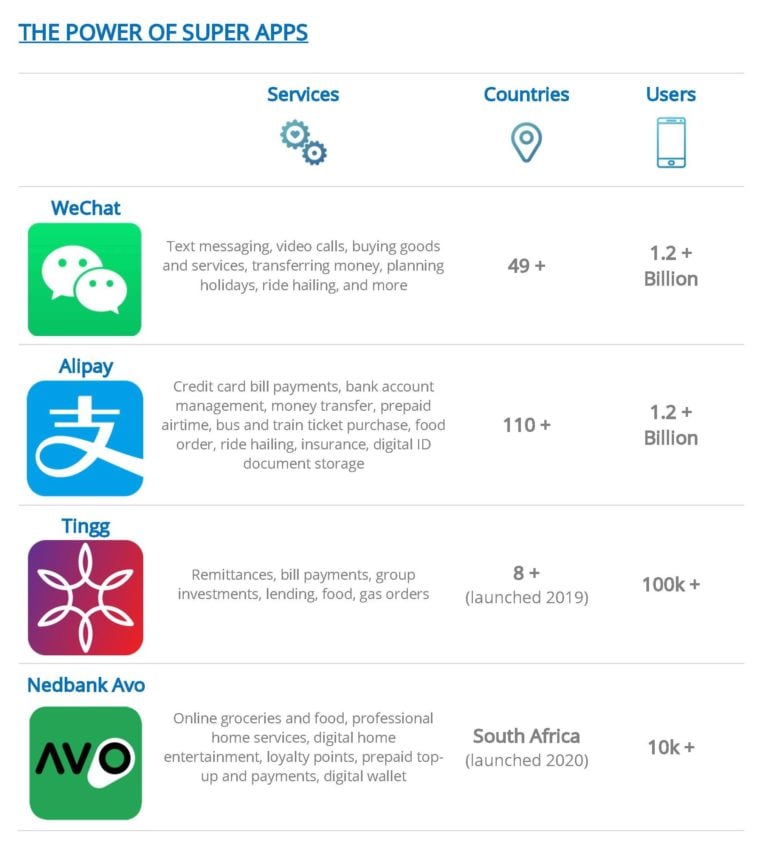

A super app is a single channel or portal that opens up a wide range of digital goods and services for the user. The most successful super apps are WeChat and Alipay, bundling together instant messaging (think WhatsApp), social media, marketplaces (eBay) and services (such as Uber). This means that all of these services can be accessed on one app, with one sign in, and one user experience. You can imagine a WeChat user in China setting up a date with a friend through instant messaging, making a restaurant reservation, booking movie tickets, ordering a taxi, and paying for each transaction along the way - all by using just one app.

Although super apps have been predominantly a phenomenon in the East, the first super app in Africa was launched in 2019. Tingg is described as an all-in-one, multi-functional consumer super app that includes a wide array of payment, commerce, and financial services into a single platform. Nedbank has just launched Avo, bringing customers and businesses together and linking lifestyle and services offerings with payment options.

Why should banks take notice?

So, are super apps an actual threat to the financial services industry, particularly in South Africa? WeChat and Alipay offer a range of basic banking, savings, and investment products to consumers. These are still originated and underwritten by traditional financial service institutions - for now. But this does mean that banks are already one step more removed from their customers. The super app is responsible for the customer experience and therefore controls the customer relationship.

These super apps have access to huge amounts of customer information and data, and more importantly, know how to use this information. They make use of this data to enhance the customer experience through strategies like targeted marketing which improves user experience, thereby building trust and their reputation.

As super apps are growing, they are developing strong relationships with banking arms. WeChat has WePay for payments, and WeBank for banking products. They are using the app’s strong user base and reputation to access new customers and build trust in their financial services offering. This poses a direct risk to traditional financial service institutions as they are targeting and attracting your customers.

What can banks do to stand out in a world dominated by super apps

1. Revisit your digital strategy

This needs to be up-to-date, relevant, and needs to cross silos in your organisation. Consumers are wanting ease and convenience when using apps and your services - does your app measure up?

2. Offer a seamless digital experience

Make sure your digital goods and services offering is ahead of your competitors’. In these times of the super app, allowing your customers access to basic VAS products is a must. And offering the required VAS products is one thing, but you also have to make sure that you are offering these services in a convenient and easy-to-use way.

Do you offer various payment options to your customers such as scan to pay, contactless QR payments, or digital wallets? Customers are looking for convenient and easy ways to pay.

Take a leaf out of the super app playbook and look at your customer data and analytics. You need to understand what your customers want and respond to that in order to compete with the great job being done by other super apps.

3. Look at your partnerships

The super app allows users to access the services of third-party merchants without having to download extra apps. This means they have a strong and extensive partnership network and ecosystem. You will need to start building your network if you want to expand your services to compete.

4. Pay attention to privacy

Our recent research into digital goods and services shows that consumers will only adopt new payment methods if they are secure and easy to use. Some super apps have bad reputations when it comes to information security and sharing of private user information. This is one area where you as a bank can get ahead of super apps and build a positive reputation. Pay attention to user privacy and build a brand that is trusted by customers.

5. Respond quickly

There is currently no market-leading super app in South Africa, but the opportunity to dominate is closing. There is still a chance for banks to take the lead and build a trusted and user-friendly super app. In order to compete, banks will need to leverage partnerships to bring different industry players together within a single app, quickly.

Are you ready to supersize your app and grow your VAS and digital payments offerings? Contact us today to explore how Electrum can help your business.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape