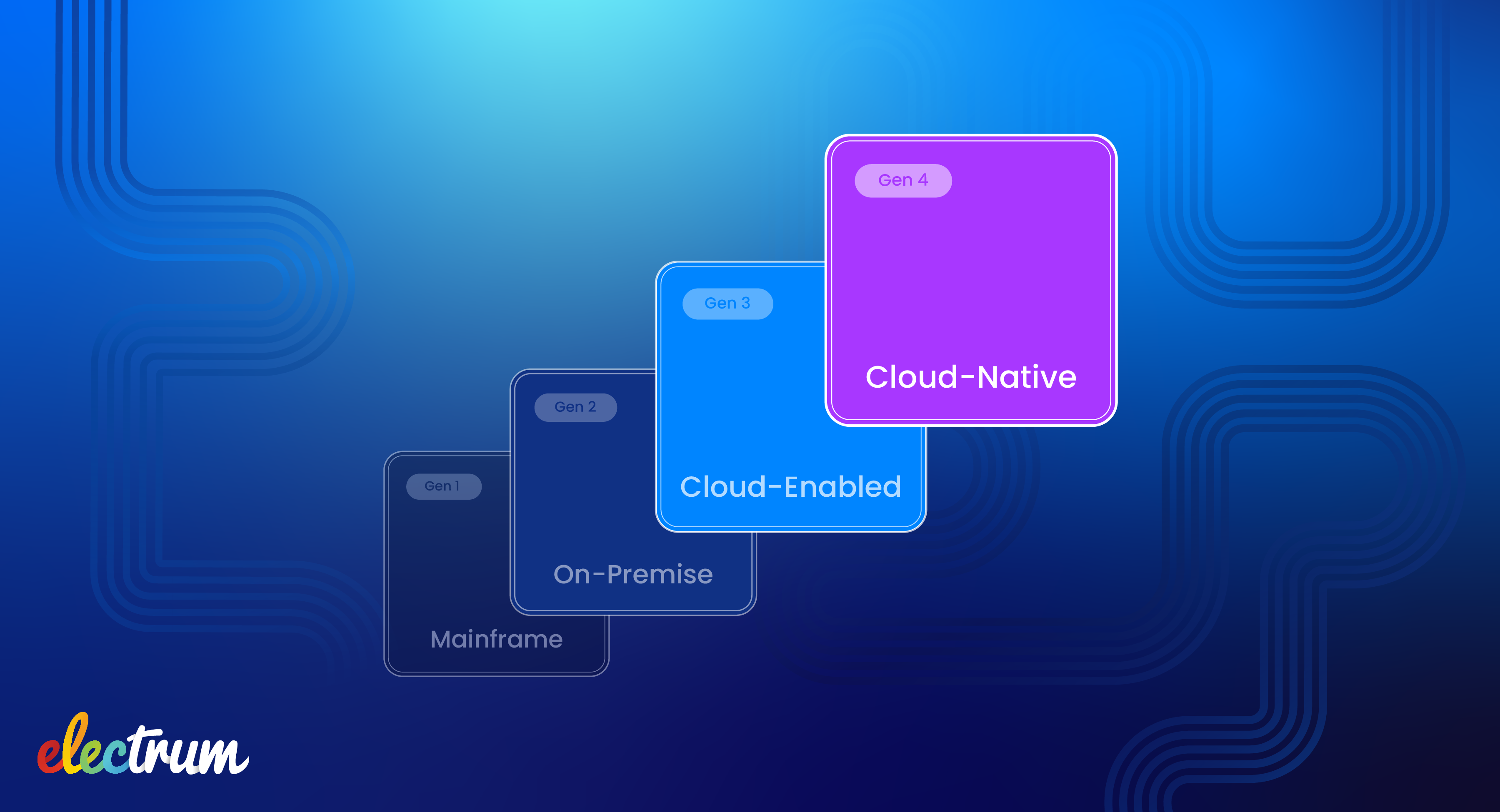

Cloud-based services have undoubtedly changed the payments industry. New technologies and functionalities are removing complexity and increasing reliability. This blog looks at how we arrived at cloud-native services and explores the opportunity for banks to modernise using cloud-native solutions.

What is cloud-native?

Cloud-native, or cloud-based, applications are designed and deployed specifically for cloud environments. They are hosted in cloud infrastructure such as Amazon Web Services and are designed to take advantage of the attributes of cloud computing:

Built on open-source technology

Cloud-native applications were created by the technology giants to support their own service offerings. Cloud industry leaders now expect innovation and excellence from their in-house teams to support their own growth, while also commoditising their backbone.

Services are tried, tested, and scaled and are constantly being repackaged to be more robust.

Everything runs over the internet

Technology will always be up-to-date, the latest version. Additionally, there is trust that the internet is safe and fast enough for today’s processing requirements.

A commitment to staying future-fit

The technology giants are committed to staying future-fit: delivering agility within their own service offering.

The modernisation opportunity

Due to these attributes of cloud-native technology, modernisation with the cloud brings speed and agility, reduced complexity, and scalability to services. Three macro forces in the current ecosystem are creating the opportunity for agile and innovative banks to gain market share and provide stand-out solutions to their customers.

1. Changing regulation

Regulatory changes are driving greater industry participation, allowing non-participants to enter the market and offer solutions to consumers. The cost of not innovating or moving ahead of the industry is that other companies may control the user experience attracting your customers and leaving you behind.

2. The move to the cloud

Banks are modernising and investing significantly in future-fit architecture. Cloud technology enables seamless and more efficient delivery of software. Legacy technology is preventing banks from being leaner and cheaper.

Cloud technology can be leveraged to increase speed to market and responsiveness to consumer demands.

3. Consumers shifting to digital

There is greater consumer demand for convenient, always-accessible, mobile, digital services.

Hyper-personalisation is coming into play and creates an opportunity to step up user experience and value, especially in digital channels.

Specialised partners enabled by the cloud

Leveraging cloud solutions enables businesses to embrace the power of partnerships. Specialised technology providers allow banks to continue to focus on their core business and build new use cases for customers, quickly. Cloud services provide access to technology that would traditionally be very expensive and resource-intensive to run on-premise.

Electrum’s solution has been designed from the ground up to be cloud-native, taking advantage of the robust, scalable, and secure infrastructure offered by modern cloud computing. Being the first company on the continent to be recognised as an independent software vendor (ISV) in financial services underscores our commitment to delivering best-in-class, cloud-native payment technology.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape