Request-to-pay (RTP) is one of the three pillars of functionality making up the Rapid Payments Programme (RPP). It is a messaging service that allows consumers and merchants to digitally request a payment from another person, using either the person's account number or a proxy for their account, for a specified amount.

Although a new initiative in South Africa, RTP is already in use in many countries around the world, with examples including

-

Europe: EBA Clearing launched RTP in November 2020

-

UK: Pay.UK launched RTP in June 2020

-

USA: The Clearing House is now live with RTP

-

India: Unified Payment Interface (UPI) Collect in India has been live since 2016

-

Hungary: RTP went live in early 2020

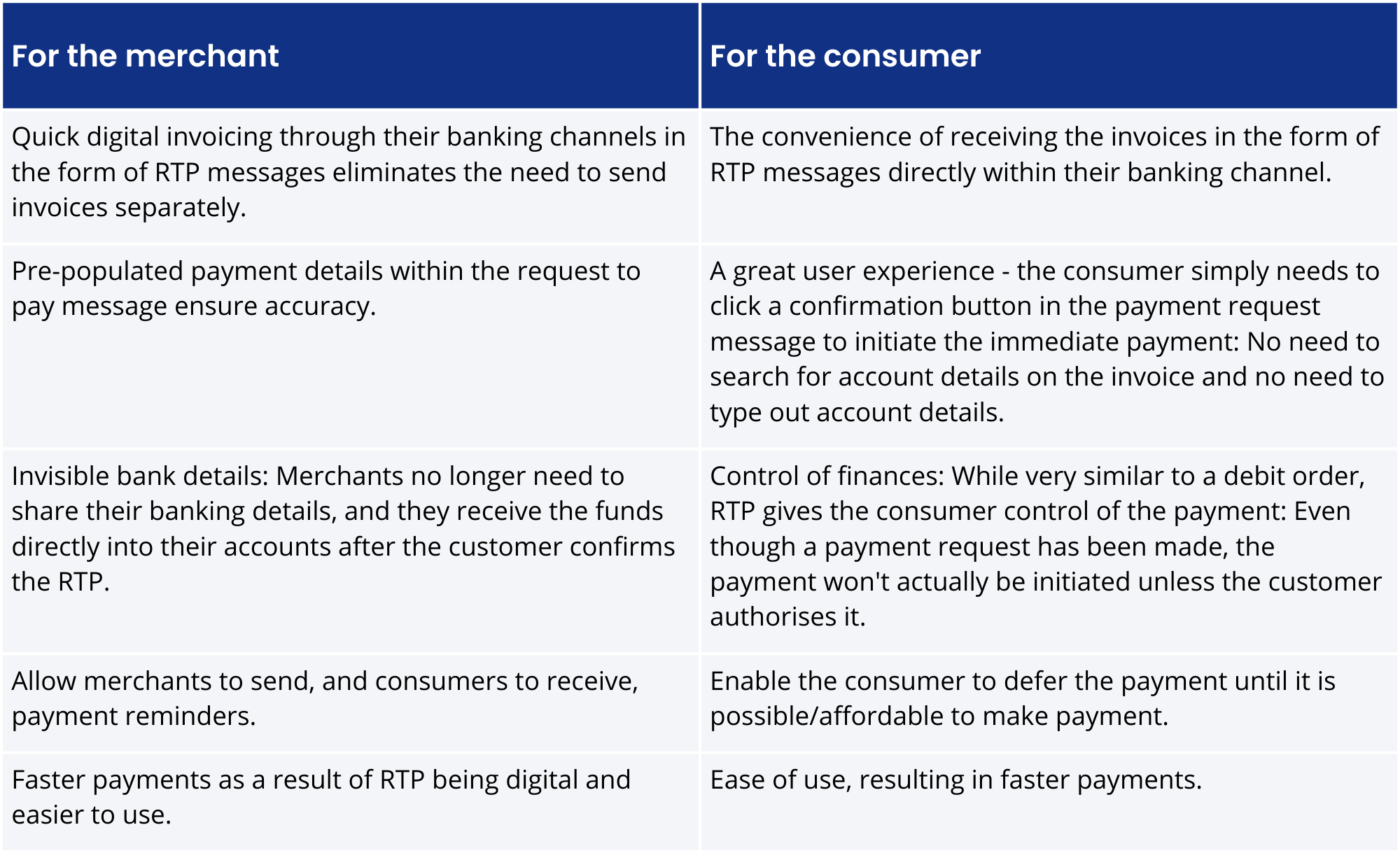

How can banks help merchants and their customers benefit from RTP?

These benefits are a result of the strong use cases that exist with RTP: Proving the opportunity to improve consumer experience and give merchants access to faster, easier payments.

-2.png)

-2.png)

-2.png)

An innovative use for RTP

In one possible use case the bank acts on the payer side and can choose to build themselves a way to store RTPs. This ‘RTP warehouse’ could keep a record of all RTP requests that have been received from payee banks but have not yet been actioned by the payer customers. That is, the bank has received an RTP, and notified the customer that a payment is due, but the payment has not yet been initiated by the payer. Normally there would be a specific time set for each RTP within which it needs to be actioned by the payer customer.

This means that the bank can use the warehouse to keep track of all RTPs that are pending payment. They can use this for reporting purposes (e.g., at any given time tell how many RTPs in total are outstanding for a particular customer). More importantly, the bank can use this for improving user experience and functionality. For example, as the RTP's expiry date comes closer, the bank can send reminders to the customer of the payment that is due.

Simplify batch payment requests with RTP

The bank may also sit on the payee side. For business or acquiring banking, the bank's payee customers are all merchants who may wish to load large volumes of RTPs into the warehouse over the course of a month, and only then initiate the payment request messages to be sent to their customers simultaneously (similar to batch invoices).

Adopt RTP’s modern capabilities

The powerful use case possibility provided by RTP is one of the reasons why it is rapidly gaining popularity globally. The modern capabilities of this service are allowing banks to provide increasingly-improved user experiences to their customers. Most importantly, by offering request-to-pay, banks are allowing merchants and consumers to enjoy more flexibility and control over their payments and banking.

We would love to explore which use cases will add the most value to your business and your customers, so reach out to us today to have a chat or follow us on LinkedIn for more payments insights.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape