Bank legacy systems are trusted. These systems are reliable, functionally comprehensive, and simply put: they work. Although these legacy systems are reliable and undeniably good at what they were built to do, they can be expensive to run. Changing legacy systems themselves is a risky and slow process.

How do banks mitigate the risk of change while also addressing the need to modernise? This is one of the conundrums that banks face when thinking about their legacy systems. The answer lies in modernising alongside the payments backbone and not making changes within the legacy system itself.

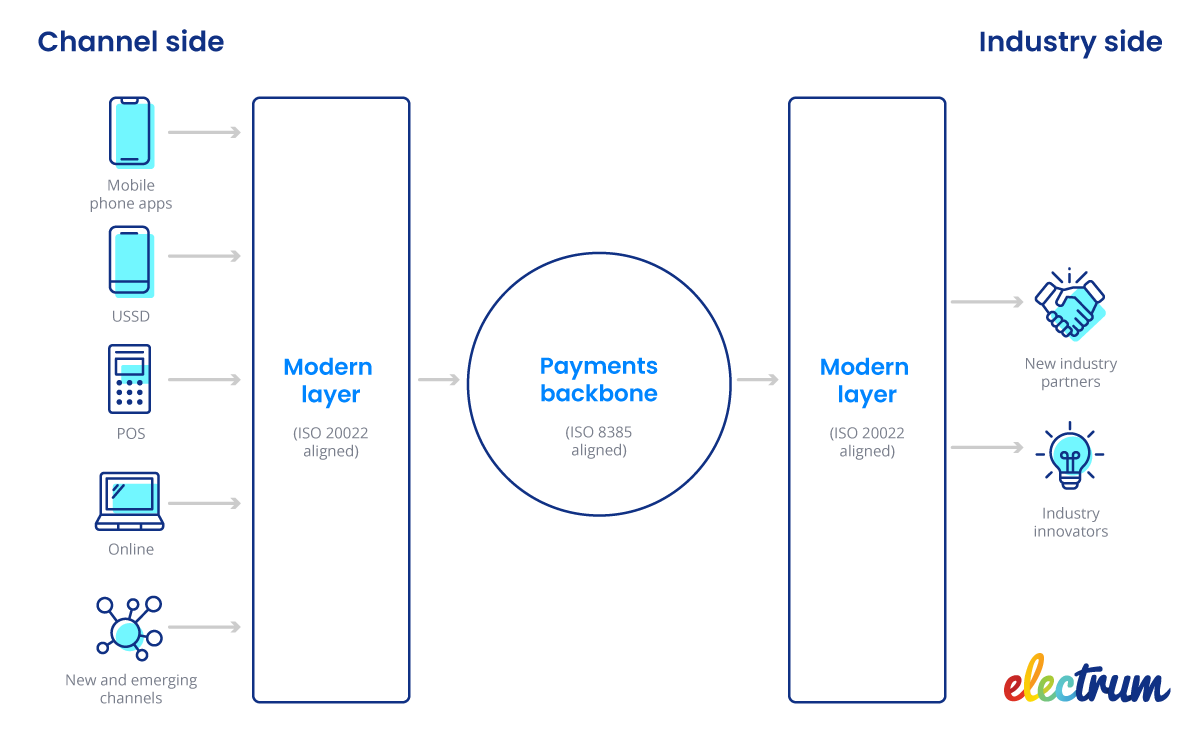

It is possible to modernise by adding modernisation layers in front of and behind the legacy system. This means that the payments backbone, the centre of the payments processing system, remains stable and unchanged while innovation is taking place at the edges.

There are certain services that do not need to pass through the legacy system, such as request-to-pay transactions. Adding modernisation layers for these services has an additional benefit. When new services utilise the modernisation layers, capacity constraints on the legacy system can be avoided, allowing any changes to the payments backbone to remain deliberate and focused on its core function.

The modernisation layers are most often added in two places: downstream, on the ‘channel side’ and upstream, on the ‘industry side’.

Channel side

Modernising on the channel side ensures that you can continue to innovate without having to change your clearing system.

Currently, we are seeing that channels are developing faster than the solutions in the industry and banks are left on the back foot. The risk of always playing catch-up is that your technology will end up being a constraint to the channel. This limits the ability to make full use of the channel’s new and emerging features. You want your solution to be optimised for the specific channel and use case: this way you can capitalise on the innovation potential that comes from new channels.

An example of this need for optimisation is comparing personal banking to business banking. Each scenario has different constraints when it comes to EFT management, however, no matter where an EFT originates it is processed in the same way. A modernisation layer will allow you to create bespoke customer experiences allowing you to respond quickly to customer needs, while your core legacy system continues to process all EFT transactions. New channels can easily be catered for by accommodating specific requirements, but the processing will remain reliable and, importantly, continue to align to all regulatory requirements.

Industry side

Modernisation layers on the industry side make it possible to integrate with new industry partners, support new industry initiatives, and connect to the newest technologies.

The PayShap initiative is a prime example of an industry change. With the new rails required to run this Rapid Payments Programme, having a modern layer capable of processing these transactions is a make or break in terms of how your bank can respond to this initiative. This also dictates how quickly you can implement this for your customers.

Modify the core, when you are ready

There is an added benefit to taking this approach to modernising your system. By modernising on the edges, when you decide it is the right time to fully replace your legacy system you simply replace the middle, payments backbone layer. Your existing modernisation layers will remain and you avoid having to start all over again. This gives you peace of mind while modernising, knowing that you can make the decision to replace the core when it best suits your business’s needs and makes the most sense economically.

Your modernisation partner matters

When it comes to building any modernisation layer, it is important to choose a partner with a proven history of understanding legacy systems. The expertise and knowledge of how to safely integrate into your system is key and a big difference will be made to your speed to market.

Speed to market is a critical factor in your bank’s modernisation strategy since you want to be able to respond to consumer demand and industry changes as quickly as possible. With the right partner you can turn on new services rapidly and have confidence in your solution.

When the time comes to replace your legacy system, find a partner that will make the process cost-effective and seamless. Your partner needs the expertise and background to ensure that the layers and core system continue to integrate with one another regardless of how the industry develops.

South Africans are rapidly adopting digital banking and emerging digital channels. Partnerships are becoming an increasingly important part of this ‘new normal’ and payment platforms are playing a crucial role in making digitization possible for legacy banks. Ultimately, the right partner will elevate your business and help to make you a market leader when it comes to modernised payment offerings.

Payments Platform experts, such as Electrum, have a successful history of working with all systems. With expertise working with both legacy and modern systems, Electrum will ensure that modernisation is fast, painless, and reliable.

Contact us today to discuss how we can help your business on your modernisation journey.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape

-Nov-21-2023-06-47-10-7922-AM.png)