How can banks offer a stand-out corporate banking solution to their corporate clients? The answer lies with modernisation, and leveraging technology partners to maximise efficiency and customer experience.

According to McKinsey Panorama, global banking revenues are expected to rise by 9% a year through 2025, with corporate or business customers at the centre of this growth. With the current modernisation drive taking place in the South African payments industry, banks should be examining their offerings. This includes a strategic look at where they can level up their solutions and provide their corporate clients with optimised services.

Most existing corporate solutions are based on legacy integration systems which lack robustness and agility. With these systems, corporates are not offered an easy solution to access a variety of clearing house payment (CHP) rails and have limited functionality (such as optimised routing or automated reconciliation).

Coupled with this limited functionality is the risk that, if a bank can’t offer a modern, robust, and versatile solution to their corporate clients, these businesses may start considering participation in other ways with the National Payment System (NPS). This risk may become increasingly significant as regulation changes to allow broader participation in the NPS for non-banks.

Incorporating modernised technology is a critical part of scaling your corporate client solution and offering your clients an elevated service. Three factors form part of this modernisation: increased efficiency, offering an improved customer journey, and adding value to your clients.

1. Increased efficiency

In a similar vein to consumers and individual users of banking services, corporate clients want streamlined, user-friendly digital access to banking solutions. And, importantly, this includes onboarding.

As a bank, a significant pain point has the potential to be a slow and ill-defined onboarding process for new corporate clients. This not only delays your ability to start generating revenue after a successful onboarding but can result in a frustrating and negative experience for the user.

Often, a corporate client continues to struggle with processing or reconciliation long after going into production with their solution due to incorrect implementation and insufficient testing.

Well-defined, technology-enabled processes make significant strides towards streamlining the onboarding process and creating a smoother journey for your client. The end result is a much faster onboarding and a more efficient path to revenue generation for both your business and your corporate client.

Some examples of increased onboarding efficiency include a corporate solution that offers:

- Well-defined APIs and supporting documentation.

- A single API that gives corporate customers access to a variety of CHP streams - resulting in the simple addition of new integrations.

- Dedicated teams to assist the business customer during onboarding.

- A self-service, 24/7-available and full-featured testing platform with comprehensive test packs and documentation.

As a result of a more efficient onboarding process, you will spend far fewer resources on assisting corporates with onboarding and production support.

2. Improved customer journey

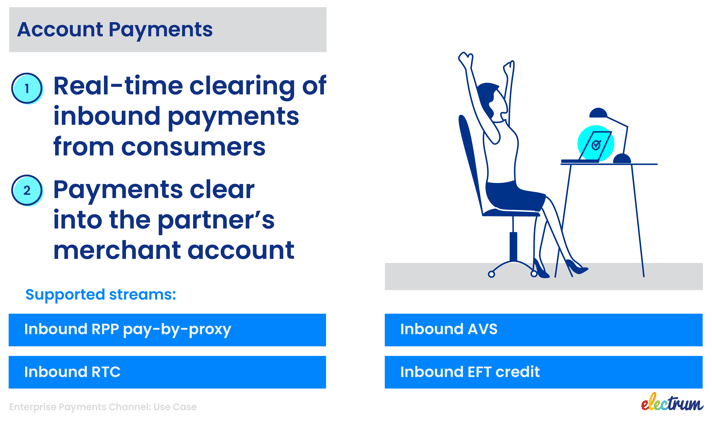

An improved customer journey begins with seamless onboarding but then continues into everyday processes such as real-time monitoring, troubleshooting, and reporting.

One effective way a modernised solution can offer your corporate clients an improved service is by providing them with automated reconciliation of all transactions. This removes the need for time-consuming, error-prone manual tasks and frees up capacity.

Additionally, by making use of an automated system you can provide a full set of reconciliation reports to your corporate client, removing the need for them to rely on bank statements and manual means of reconciliation or invoicing.

3. Added value

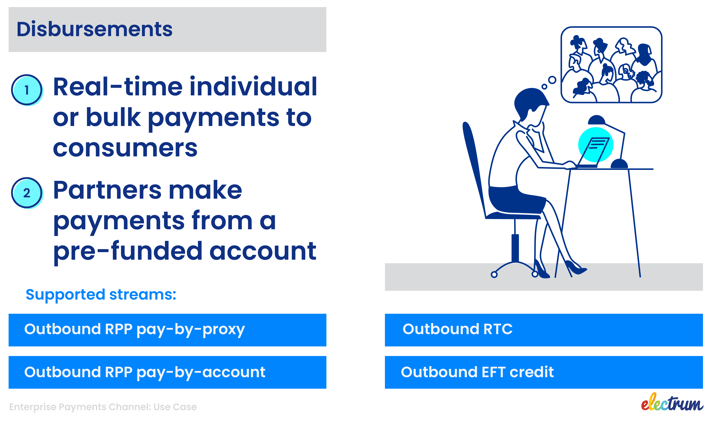

Arguably the most important way to add value for your clients is by providing them with new and innovative use cases and payment opportunities.

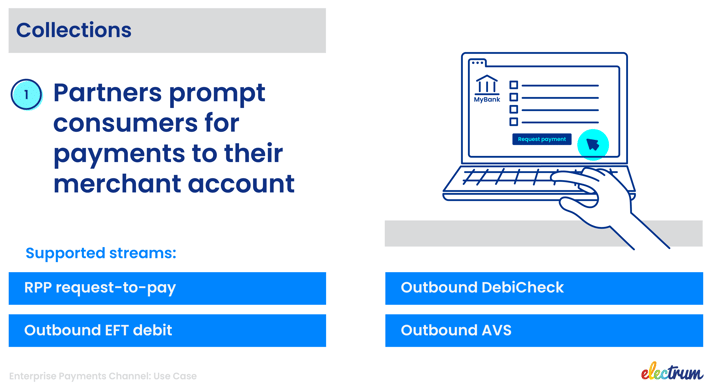

A comprehensive corporate client solution will open up opportunities for your customers to quickly add the newest payment services with all supported streams. This makes it as effortless as possible for your client to participate in new or existing CHP rails - such as PayShap - with the industry. Additionally, this enables businesses to build their own payment solution iteratively by starting with one CHP stream and gradually adding more inbound and outbound streams at a later stage.

One such emerging use case is that of proxy-based payments which can be easily enabled through the right technology. The ability to register your own domain and receive or make payments using that domain will make payments simpler and faster for your customers, and give them the edge over competitors who are slower to implement new offerings.

The technology to offer you a modernised solution

Your bank needs a solution that offers protection to the inner processing systems. By forming a layer of robustness, there will be no risk or impact on core processing when new a feature or functionality is added.

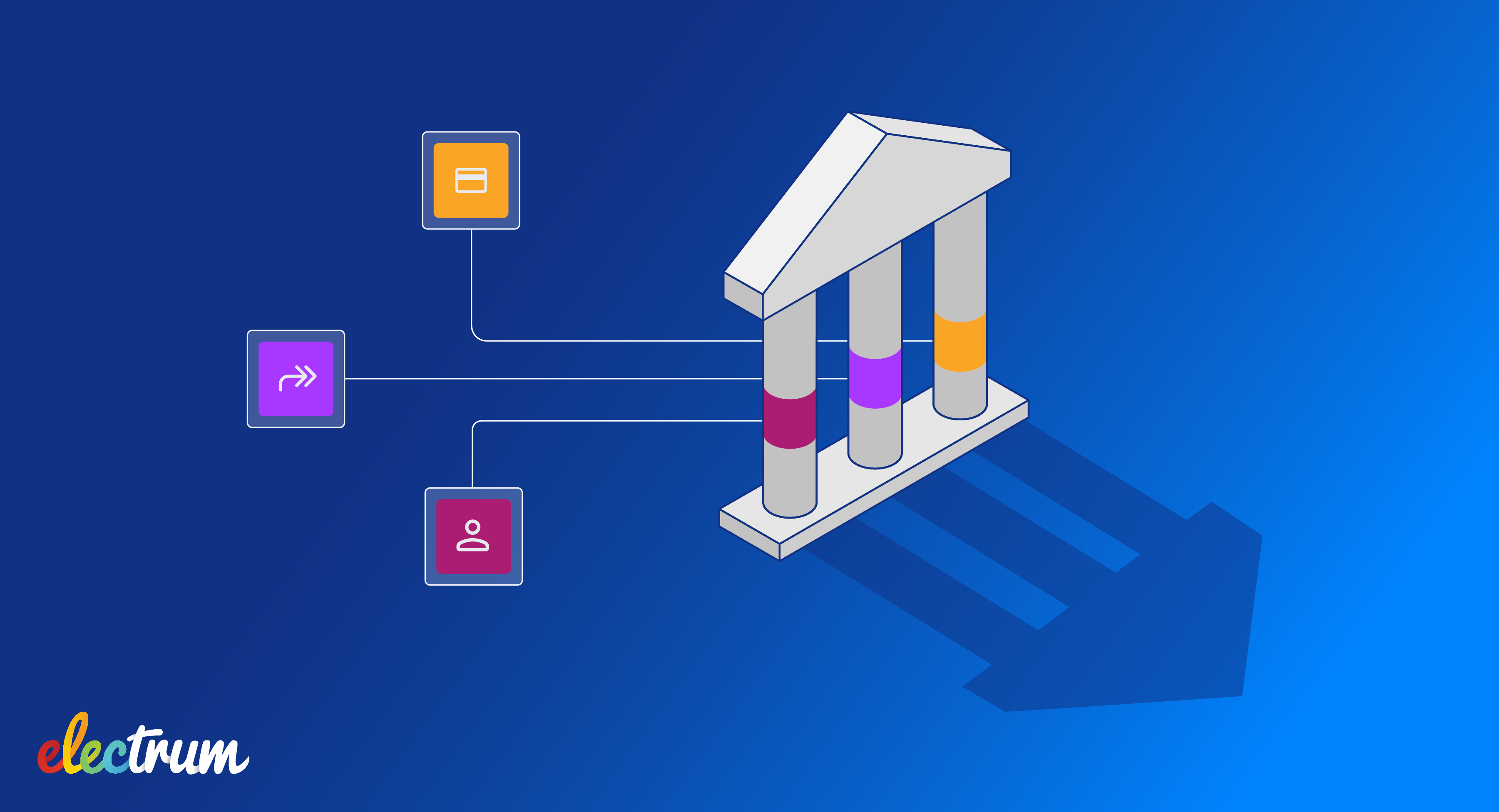

Collaboration with the right technology partner is key to enhancing your offering and staying competitive. Electrum’s Enterprise Payments Channel solution streamlines the integration and processing needed for a partner entity to participate in payments using their sponsor bank’s rails with BankservAfrica.

For a sponsor bank, Electrum removes all the effort required so the bank can simply take care of commercials and tell us when the partner needs to go into production. We take care of APIs, documentation, implementation support, and testing support. For corporate clients, Electrum will provide the assistance needed to make the onboarding process as pain-free and as quick as possible.

Electrum’s solution includes fully automated reconciliation as well as access to the Electrum Console, providing a single view of all transactions for all your corporate clients across all CHP streams.

Enterprise Payments Channel

Learn how to optimise your corporate banking offering.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape