The battle for high-value cross-border payments is intensifying as new rails provide corporates with faster, cheaper, and more transparent payment options. Banks have faced this challenge before - and lost - when new players disrupted the remittance market.

In 2024, global remittances (low-value P2P payments) reached an estimated USD 1.2 trillion in value and USD 42 billion in revenue. Banks, however, captured only 35% of this flow. Once dominant players in remittances, banks gradually lost their market share to non-bank players that were able to compete on price and better user experiences. Soon, regulators legitimised these challengers, fueling their rapid growth and entrenching their position in the market.

Today, banks are still struggling to regain their relevance in remittances, and history may repeat itself. The battle has moved to high-value cross-border payments, and the consequences of losing are colossal.

Learning from remittances: The warning signs

For many years, banks were considered the only viable option for international remittances. With limited competition, they had little incentive to innovate or drive fees down. That complacency created space for digital money transfer providers such as WorldRemit, Remitly, and Flutterwave, to disrupt the market by offering faster and affordable alternatives.

Banks had early opportunities to respond to clear warning signs that the market was slipping away.

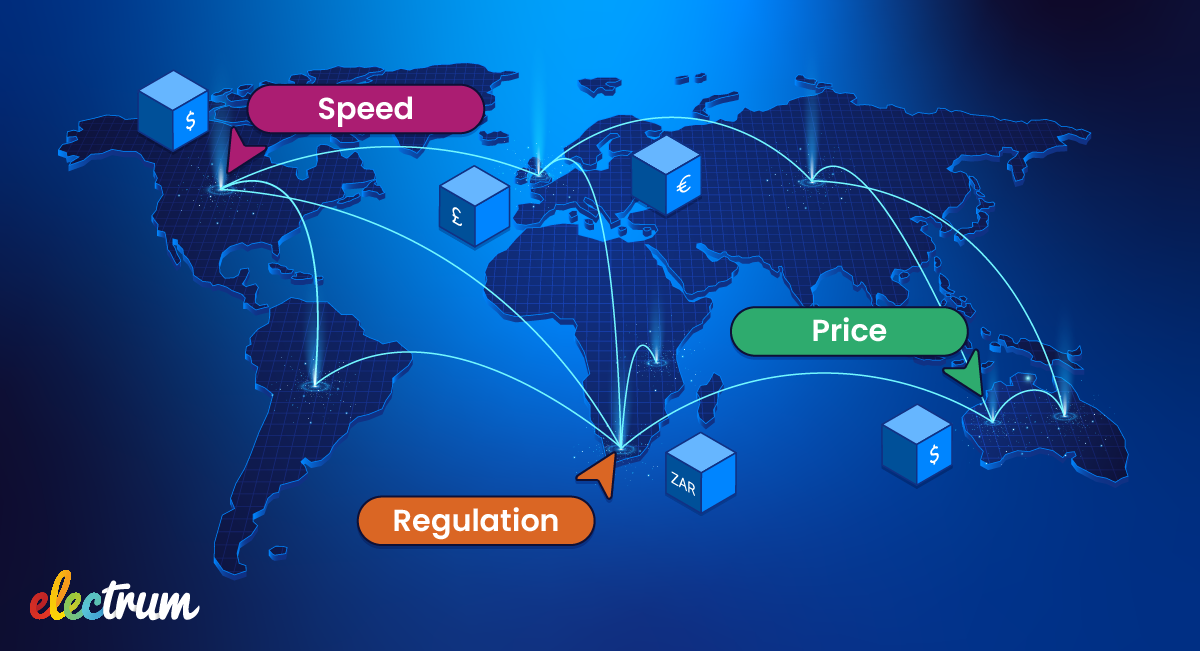

Price

As fintechs and money transfer operators scaled, benchmark data repeatedly showed that banks were the most expensive channel to use for global transfers.

According to the WorldBank, the average cost to send USD 200 through a bank has been above 10% for the past decade, climbing to more than 14% in recent years. By contrast, money transfer operators charged closer to 6% with fees continuing to fall over time.

Speed and User Experience

As fintechs entered the market, they radically simplified the customer journey. Digital KYC reduced onboarding from weeks to a day or even minutes, while banks stayed reliant on slow, document-heavy, and branch-based processes.

Fintechs also led with mobile-first platforms and wider payout networks, giving customers faster access to funds in their preferred payment method and currency. By contrast, banks offered limited choice and longer settlement windows.

Finally, transparency became a clear differentiator. Using a bank means accepting that your payment could be delayed by correspondent banks in the chain. Fintechs addressed this gap by introducing API-driven tracking that allows customers to see the status of their payments in real time.

Regulation

Regulators have a mandate to encourage competition that drives prices down and broadens access to innovative products. A key way to achieve this is to reduce barriers to entry to enable non-traditional players to operate alongside established banks. Regulation also provides legitimacy, helping consumers build trust in new service providers.

In South Africa, the introduction of Authorised Dealer with Limited Authority (ADLA) Category 3 enabled non-bank operators to operate with foreign exchange transactions, formalising competition that banks largely under-reacted to. With the playing field more level, banks could have reacted by partnering or co-creating with newly licensed operators before they reached scale.

Early warning signs in high-value cross-border payments

Banks are now facing competition in high-value payments (HVP) that echoes the early signals they ignored in the remittances market:

Price

Corporate treasurers are increasingly demanding competitive FX rates and transaction fees. New entrants are offering predictable and competitive fee structures that make it easier for corporate treasurers to plan and reconcile their cross-border payments.

Speed and User Experience

New cross-border payment rails such as stablecoin, tokenised cash networks, fintech aggregators, and tokenised card-scheme networks are challenging the efficiency of correspondent banking channels. Treasurers want predictable time-to-credit, end-to-end traceability, and real-time liquidity. Challengers are already enabling faster settlement windows, API-based tracking, and flexible multi-currency payouts. In contrast, bank-to-bank flows often still suffer from compliance delays, a lack of visibility, and a limited pay-in and pay-out functionality in countries where they are not licensed.

Regulation

In South Africa, the Financial Sector Conduct Authority (FSCA) is licensing crypto-asset service providers, while the Financial Intelligence Centre (FIC) has extended the Travel Rule to crypto transfers. This change legitimises crypto-asset service providers by aligning them with bank-grade AML requirements. Soon, as confidence builds, corporates would consider stablecoin and crypto assets as viable options for high-value payments.

Parallel warning signals |

|

|

Remittances |

High-Value Cross-Border Payments |

|

Fintechs consistently drove remittance fees down. |

New rails are providing transparent and predictable fee structures. |

|

Fintechs fast-tracked onboarding, offered end-to-end real-time tracking, and faster settlements. |

Challenger rails provide instant payments, API-based tracking, and multi-currency payouts. |

|

Formal licensing improved legitimacy and levelled the playing ground. |

Regulators around the world are defining clear rules for non-traditional rails. |

The stakes are far higher this time

The consequences of letting the high-value market slip are far more serious. Losing sight means losing core revenue and long-term growth.

At USD 173.2 trillion, the B2B cross-border payments pool is nearly 145 times larger than the USD 1.2 trillion P2P pool. But, B2B generates only about four times more revenue (USD 180 billion vs USD 42 billion), highlighting that banks are already working with relatively thin margins.

Fortunately, the window of opportunity is not closed. Banks can still proactively react and adapt to the shift in consumer expectations before new rails scale.

What banks should do

To avoid repeating past mistakes, banks must act decisively:

- Set clear mandates: Define deadlines and measurable targets such as reducing and publishing predictable fees, accelerating time-to-credit, providing exception rates, and enhancing user experience with API and cloud-native technology.

- Modernise for compatibility: Ensure existing platforms can integrate with new providers and rails, offering clean APIs, richer data, real-time status updates, and 24/7 processing.

- Go multi-rail: Retain correspondent banking while adding alternatives like aggregators, card-push networks, and regulated digital-currency rails. Route each payment according to the client’s priorities and preferences.

- Maintain compliance: While clients are looking for innovative solutions, they still want partners they can trust to protect their payments. Continue maintaining client relationships by carrying all necessary sender and recipient data with proper screening across every rail.

There isn't much time to build it all on your own. Working with payment infrastructure providers like Electrum can accelerate time-to-market without sacrificing compliance or control.

Final thoughts

Visible gaps in price and experience, combined with enabling regulation, opened the door to strong new remittance providers while banks hesitated. The same harbingers are flashing in high-value cross-border payments, only this time, the value at risk is exponentially greater. Acting early with a multi-rail strategy will allow banks to protect their core revenues, win corporate treasurers’ loyalty, and capture new growth before the market reshapes around them.

Learn more about Electrum’s high-value payments offering, or contact us to discuss your modernisation plans.

Kganya Molefe

Kganya is a freelance Content Writer based in Johannesburg with experience in African Payments. When she’s not writing, Kganya enjoys journaling the old-fashioned way, listening to podcasts during her long walks, and passionately discussing the importance of low-cost, real-time, pan-African payment solutions with her friends and family.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape