Resilience increases in value as transaction volumes grow. For banks, an unreliable payment system undermines their brand. Here’s why the cost of downtime is too high, and how smarter systems can help banks scale trust.

Globally, it's estimated that organisations lose more than $400 billion in revenue annually due to system outages. For a large bank processing 120 transactions per second at an average value of $85, a three-and-a-half hour outage could result in over $3 million lost in merchant fees alone. But that’s only the visible cost.

Every transaction processed, and every moment your system is up builds confidence with regulators, partners and customers. As transaction volumes grow, maintaining this confidence becomes harder. More transactions mean more dependencies, more moving parts, and more pressure on infrastructure. To protect trust, banks need systems that can perform consistently, predictably, and at any scale.

The true cost of downtime

Downtime causes significant cash flow disruptions, lost productivity, and substantial recovery costs. The multiplier effect of these hidden costs, including potential data loss and losing your best people, makes resilience an essential investment for protecting the entire operational base of a bank.

Beyond the bottom line, downtime has an emotional impact on trust. People expect 24/7/365 reliability from their banks. Frequent downtime paints a picture of inefficiency and unpreparedness, which is exceedingly difficult to repair and come back from. This can result in customers moving their deposits to a competitor and make their dissatisfaction known to others.

Resilience is visible

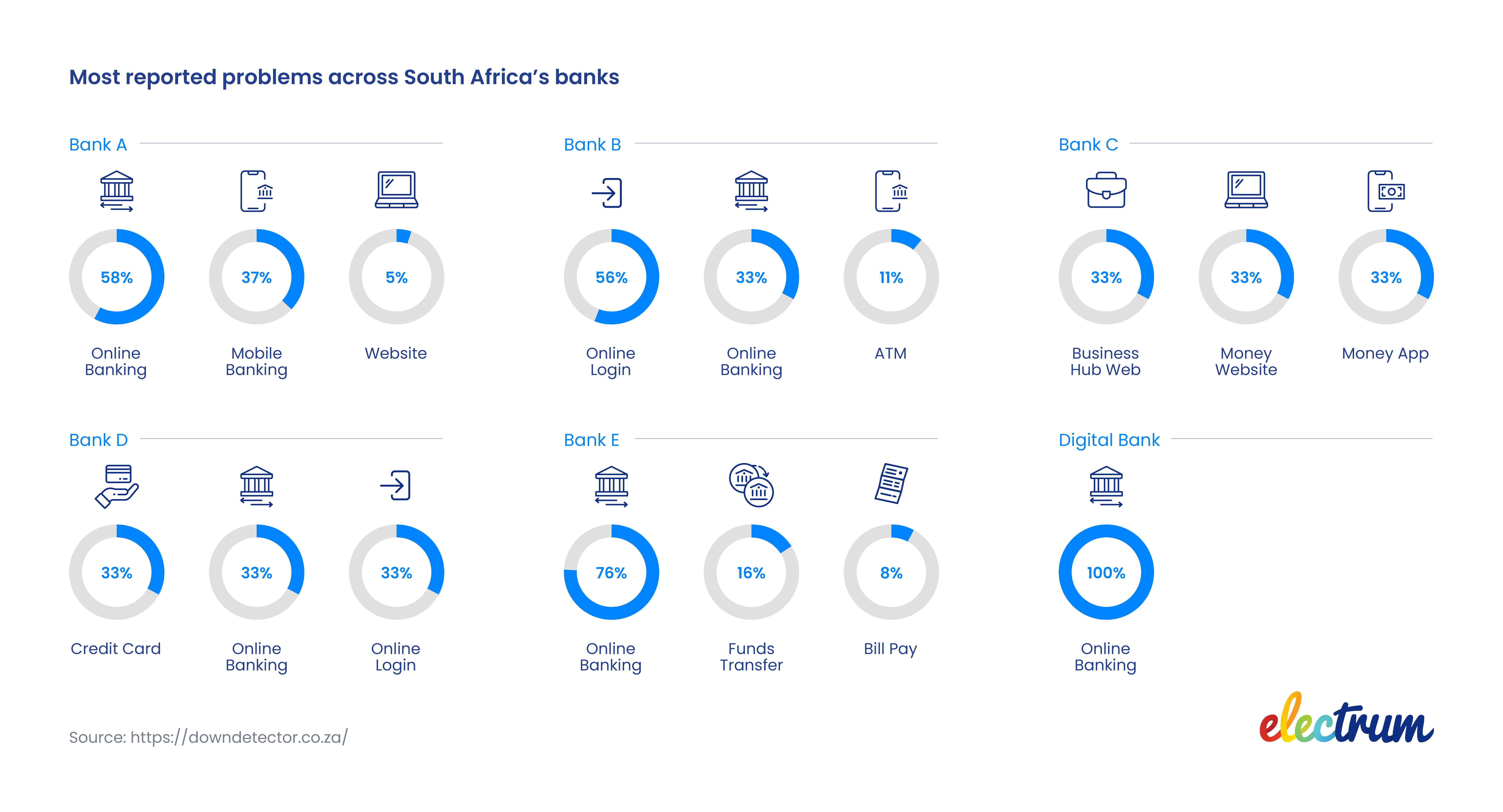

Platforms such as Downdetector now put the availability of each bank under a public microscope, allowing customers and competitors to compare system performance in real time. Customers that report a bank’s system downtime often report issues related to their online banking channel.

This transparency adds new pressure on banks: every outage becomes a reputational event. Customers can and will share downtime experiences on social media, while potential clients might use these reports to decide where to open their next account. In this environment, banks need high-performance and intelligent recovery systems to make reliability their key brand differentiator.

How AI enhances resilience

At least 45% of South African enterprises have deployed AI to upgrade risk management. Mature tools like machine learning can offer foresight to resolve issues before they escalate into outages.

For example, AI models can forecast high-demand periods, such as month-end salary runs or Black Friday, and automatically scale infrastructure to handle the surge. These systems can expand or contract capacity in real time, preventing the kind of slowdowns that feel like downtime to customers.

When failures do occur, AI-driven orchestration, although still growing in maturity, can respond by rerouting traffic, restarting failed services, or isolating the problem area. This kind of self-healing automation can help teams recover faster and free engineers to focus on complex projects that improve the bank’s value proposition rather than firefighting.

Ultimately, the hope is that AI can help banks to keep customer trust intact by moving from reacting to outages to anticipating and preventing them, even under pressure.

Looking beyond the bottom line

In payments, every second matters. Downtime doesn’t just cost money, it costs confidence. Customers understand what resilience should look like and they won’t hesitate to jump ship if they feel that they can’t rely on your system to complete payments.

To protect your bank’s reputation and strengthen its value proposition, resilience needs to be an essential part of your growth strategy. It should be treated as a product that is measured against your competitor’s best offer.

South Africa’s tier 1 banks and retailers trust Electrum’s next-generation technology to process their transactions. Contact us to discuss modernising your payments business.

Kganya Molefe

Kganya is a freelance Content Writer based in Johannesburg with experience in African Payments. When she’s not writing, Kganya enjoys journaling the old-fashioned way, listening to podcasts during her long walks, and passionately discussing the importance of low-cost, real-time, pan-African payment solutions with her friends and family.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape