Take a look into what consumers say matters most when buying value-added services, with a discussion around how to set your business ahead of competitors when it comes to purchasing VAS products.

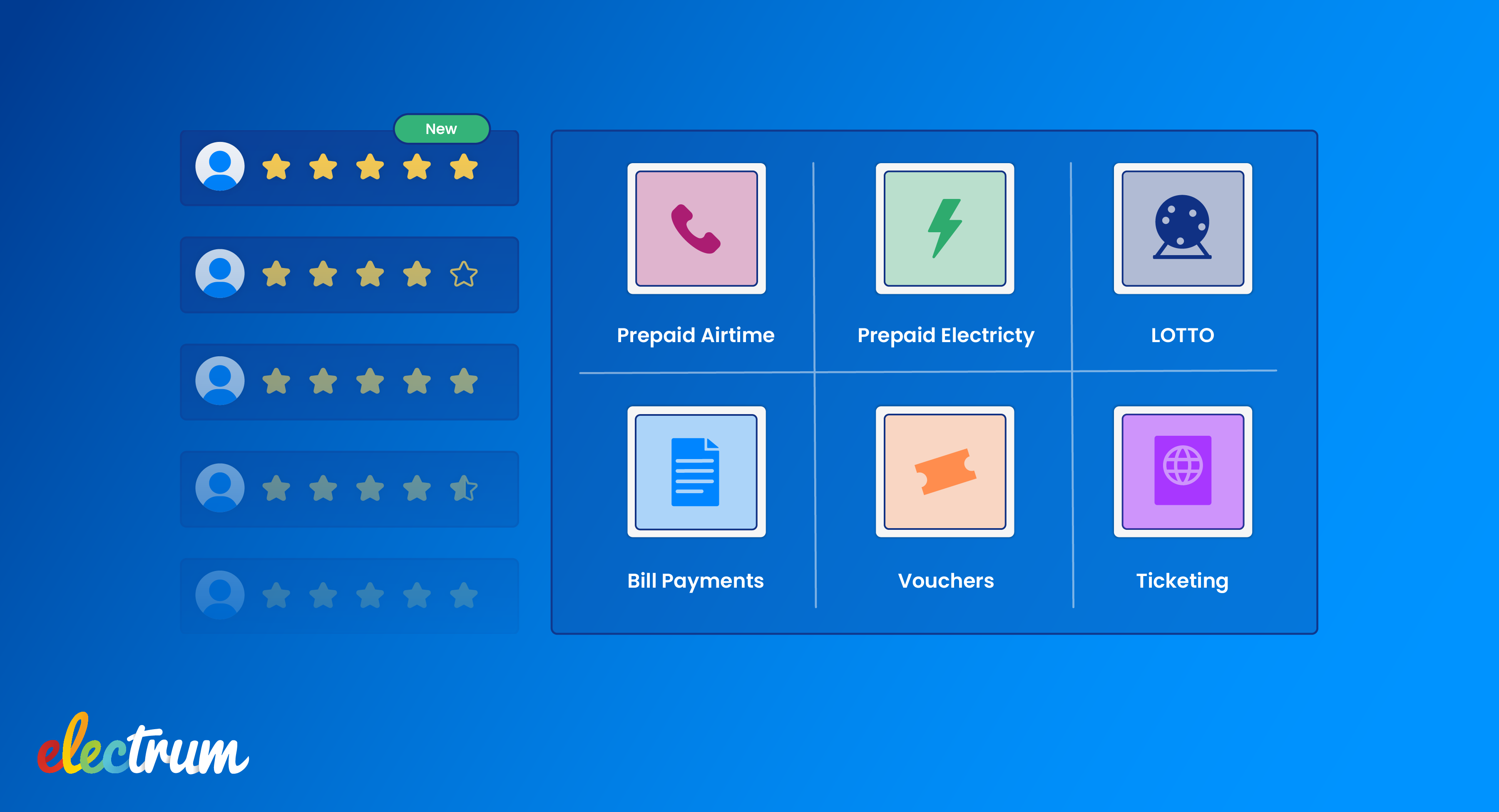

South African consumers have a well-established awareness of digital goods and services, to the extent that they have come to expect a wide portfolio of VAS products from both banks and retailers. They also access these digital products through a range of channels.

Our 2022 Digital Goods and Services Report found that overall, till points at retailers and banking apps remain the preferred channels through which to purchase digital goods and services, with both channels having grown significantly in popularity since the 2020 findings. The five most popular channels according to the research were:

- Banking app

- Retailer till point

- Money market counter

- Bank branch

- USSD

With the largest businesses in South Africa already offering their customers a mature VAS portfolio, how can you leverage the top channels to set your business apart?

1. Pay attention to the customer experience and make it convenient

In our recent research, industry experts shared that for VAS portfolios to be successful, customers must be able to complete all their desired transactions in one place. Be it through a banking app, at retailer till points or on a website. Small failures in delivery, such as your system being offline, will likely drive customers to competitors who offer the same products at a similar price point.

Consumers want to include VAS product purchases in their daily routines, so it must be easier for them to use your services rather than a competitor’s. Given that consumers visit retailers on a daily or weekly basis, they see no reason to change to digital channels because making purchases in physical stores is already ingrained behaviour. For a bank app to compete with retailer’s till points, it must be simple to purchase digital goods and services while already logged in and making other forms of payments. Additionally, if for example, prepaid electricity is unavailable at a retailer's money market counter a consumer may make it a habit to purchase it online while doing their banking.

2. Don’t drive customers away

Despite till points being one of the most preferred channels, retailer websites are one of the most avoided channels, along with WhatsApp banking, bank websites and physical bank branches. Often these channels are avoided because of a previous negative customer experience or inconvenience.

Lack of trust was especially true for WhatsApp banking and third-party payment sites on retailer websites, where consumers believed that they could be scammed or subject to fraud. Many consumers preferred to physically visit the store to buy what they needed because it allowed them to see what they were purchasing and who they were purchasing it from.

If a consumer does not understand or trust a channel for purchasing digital goods and services, then they tend to avoid it. However, the COVID-19 pandemic has resulted in many consumers moving away from more familiar physical channels due to safety concerns. This provides an opportunity to take advantage of the digital adoption trend and capture more of the market by providing seamless experiences on an app or website. As already explored, customer experience is key, so if the system doesn't function flawlessly then the risk is that customers will stop using these newer channels.

3. Technology that works for you

Finding the right technology partner is key to providing your customers with the most reliable and convenient experience. A platform with smart routing functionality, including load balancing and automatic failover, is critical. This allows your VAS business to avoid going offline, because if your first choice of provider goes down, the purchase request will automatically be routed to your second-choice provider, and so on. As a result, your customer never experiences an offline service when using your channel. In addition, customers spend less time in queues because automatic routing between different providers means that there are fewer retries. Getting their VAS product to them faster leads to increased satisfaction and a higher chance that you will retain them as a customer.

Contact us today to find out more about Electrum’s smart routing VAS solutions, or sign up now for more insights from the 2022 Digital Goods and Services Report.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape