Digital wallets allow consumers to load and access a store of value (SoV) on their mobile devices. When enterprise retailers integrate to digital wallet service providers, they make it possible for consumers to transact at their stores using those digital wallets. This means that the digital wallet opportunity for retailers centres around offering the best possible user experience to your customers by opening up more convenient ways to pay.

Understanding the drivers behind the rising popularity of digital wallets can give us insights into why consumers are gravitating towards this payment option. These drivers include:

-

Mobile phone penetration, with a third of South Africans now using a smartphone.

-

Expanded QR code payment options at retailers and online, coupled with increased consumer familiarity with QR code payments.

-

A rise in open banking resulting in easier integration and collaboration between third party payment providers (TPPPs), fintechs, retailers, and financial institutions.

-

The rise of super apps and one-stop-shop options for value-added service marketplaces.

-

The lack of and/or inefficiencies around traditional banking infrastructure, including limited access to ATMs and banks in rural areas, and safety concerns around carrying cash.

Give your customers more ways to pay

Since digital wallets allow consumers to transact using a store of value that is held at a third party service provider, you give consumers payment options. More ways to pay at till points and on digital channels result in fewer abandoned carts when it comes to checkout.

With industry research confirming that consumers are interested in new payment technologies, businesses are expected to adapt, modernise, and provide omni-channel offerings. In the same research, over 80% of South African respondents agree that they prefer to shop at stores that have both an in-person and online presence. Additionally, 75% say they are more loyal to retailers who offer multiple payment options. This shows the importance of retailers making it easy for customers to pay using the channel that is most convenient to the individual - including across all of your digital channels, as well as at the POS.

Digital wallets have an added advantage over traditional payment options in that users do not need to have a formal bank account to open and transact using a digital wallet. This opens up digital payment options for the retailers’ underbanked customers. If your business offers these options ahead of competitors, there is a good chance you can gain market share in this sector.

Offer a frictionless payment journey

In addition to broadening payment options, digital wallets are easier to use; can be frictionless when compared to conventional payment methods; and more convenient. The rising popularity of scan-to-pay and tap-to-pay methods show how consumers are responding to contactless payments; not having to carry bank cards; and limiting the use of cash. As these options become more commonplace, consumers are coming to expect more than just card and cash payment acceptance at large retailers.

Just one example of frictionless customer journeys is the increase in payments through wearable technology such as smart watches. If your enterprise business can accept these emerging forms of payments ahead of your competitors, you can cement the reputation for providing the most convenient payment options and win new customers.

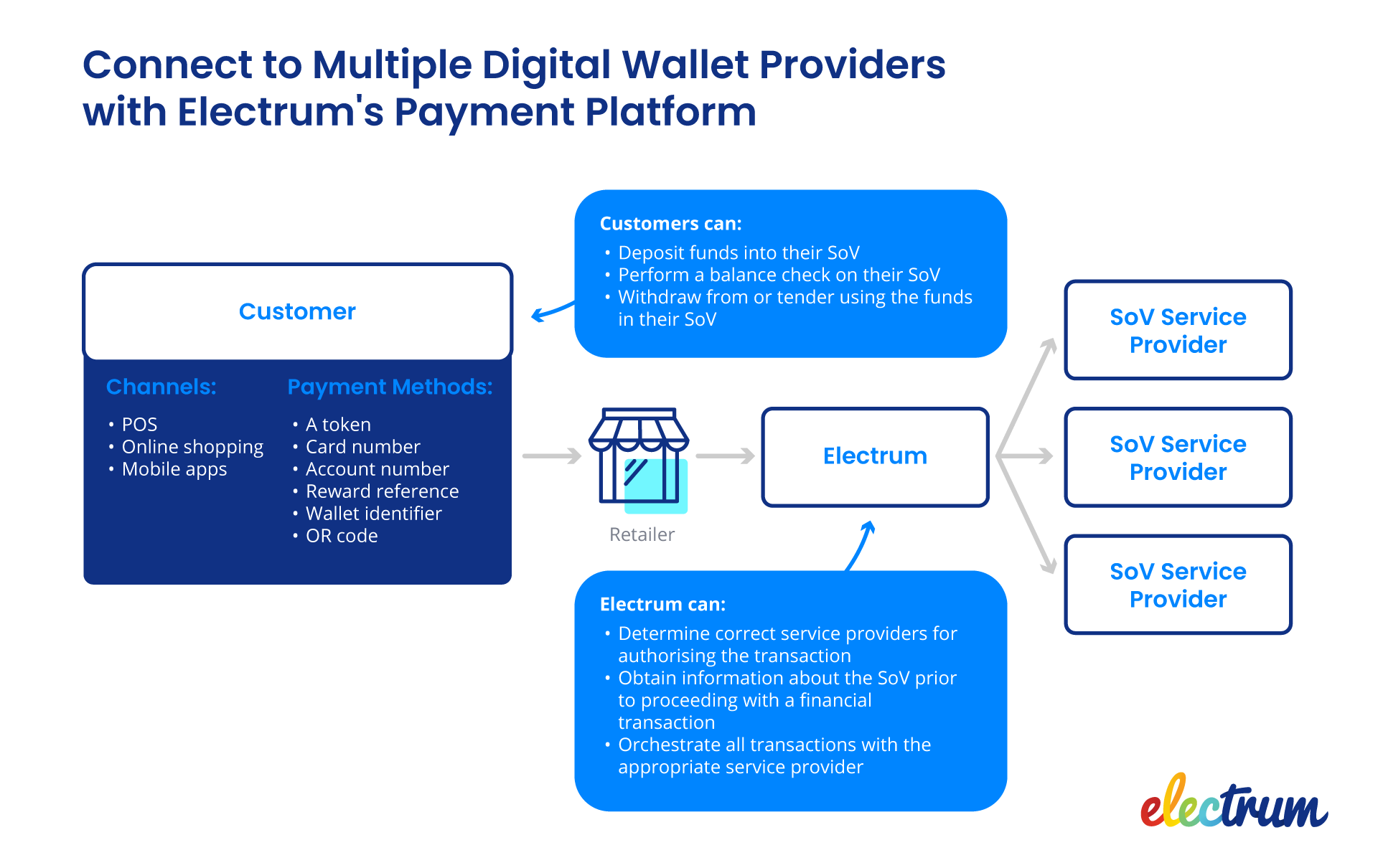

Integrate to multiple wallet service providers

Pick n Pay is a prime example for accepting multiple modernised payment types across different providers. Customers can pay with a VodaPay digital wallet, using QR code payments through Masterpass, or even by using cryptocurrency.

Creating the best payment experience for your customers is possible with a Payments Platform that can connect your business to multiple service providers - including digital wallet providers. This way, you can give your customers as many options as possible, and take new services to market quickly.

More digital wallet integrations give you the opportunity to promote more favourable commercial agreements with specific providers. For example, you can encourage and incentivise customers to choose paying with one wallet over another if you have a more lucrative fee structure with that specific provider.

Each digital wallet service provider can have different specifications when it comes to integrating with your system. Electrum’s Payments Platform has proven expertise when it comes to managing these integrations and can manage this complexity for your business - making it simple to integrate to multiple service providers.

Chat to us today to explore how we can help you build your Digital Wallet service with Electrum Payments, and take your offering to market as soon as possible.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape