Getting reconciliation right is a key part of building a successful high-volume digital goods and services portfolio. Having an automated reconciliation tool brings more accurate results, predictable timelines, and streamlined reconciliation and settlements. This blog will help you understand what you should look for in an automation tool before selecting one.

A digital goods and services portfolio has become a key offering for many consumer-facing businesses, helping with customer retention and increasing additional revenue. Some of these services, such as prepaid airtime and data and prepaid electricity, are purchased in high volumes. As a result, manual methods - which usually entail sitting with multiple spreadsheets and trying to match transactions one-by-one - end up taking longer and leaving room for human error. This manual process is impractical and risky, but fortunately, automated reconciliation tools solve the problem. Before you choose a tool that will automate your processes, it’s important to know exactly what your business needs.

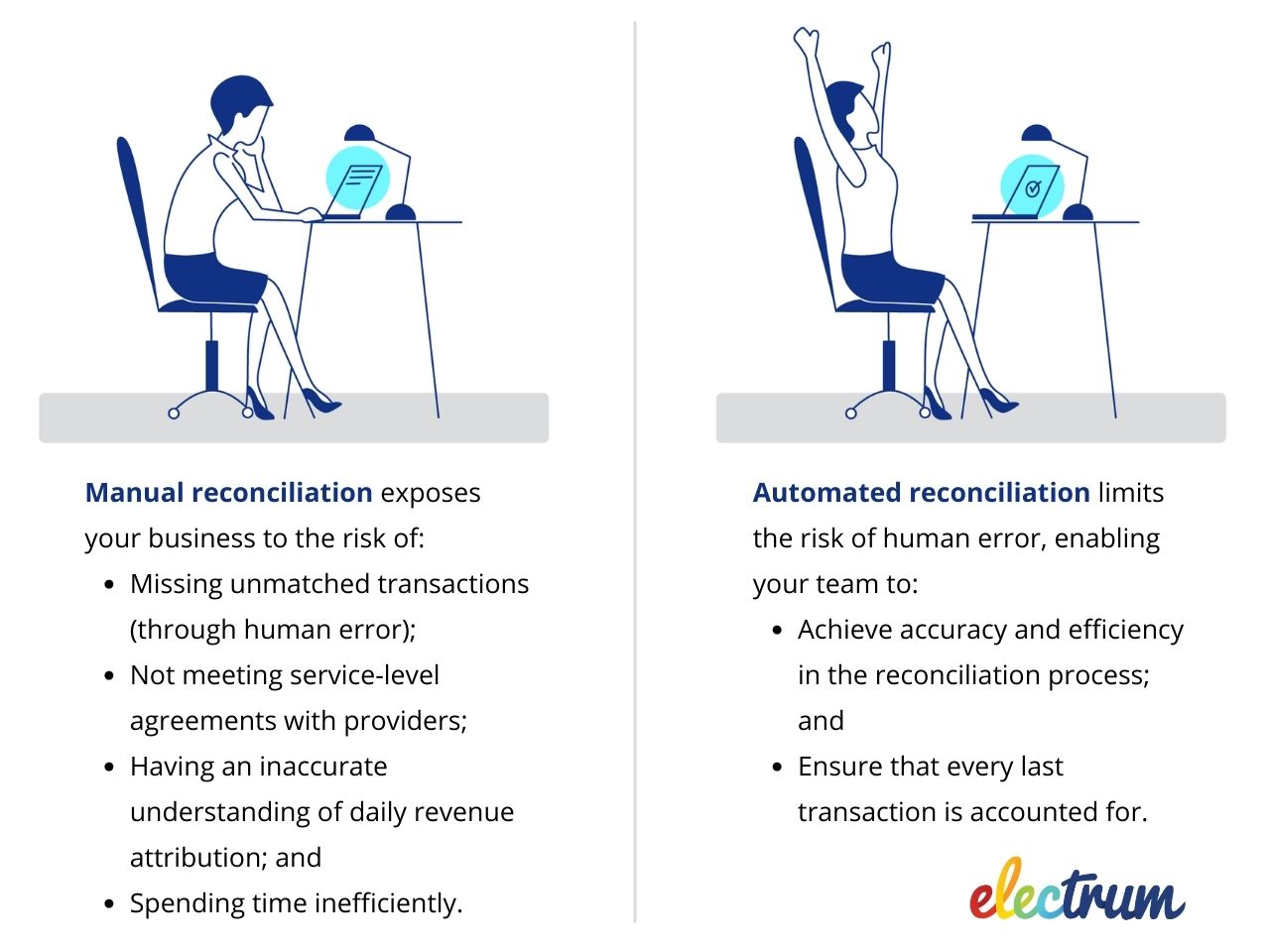

Understanding the challenges of: manual reconciliation

High-volume digital goods and services come with high volumes of transaction data. This creates time constraint stress, meaning your team may not be able to reconcile every last transaction within the prescribed reconciliation window. This opens your business up to the significant risk of human error.

Automation Improves Your Reconciliation Process

What to look for in a tool for automated reconciliation

1. Upfront transaction matching

Automated reconciliation tools use transaction matching to compare your mark-up files against your VAS provider’s mark-off files. This reduces manual intervention from the outset, giving your team the ability to focus only on unmatched transactions and exceptions. With significantly less time being spent on confirming matched transactions, your team will have time to conduct efficient investigations.

2. Guaranteed daily reconciliation files

When you enter into a contract with a digital goods and services provider, you agree to meet specific SLAs. For example, producing a daily reconciliation file. An automation tool uses matching logic that is fast enough to predictably produce reconciliation files. This can give you peace of mind, knowing that you won’t experience recon-related settlement delays.

3. Scalability for when your business grows

An automated reconciliation tool can help your process of scaling up run more smoothly through its capacity to keep up with your digital goods and service portfolio as it grows. It should offer quick and easy integration, and scalability for when you add more VAS providers (which could quickly lead to an increase in the number of transactions that need to be reconciled).

4. Limited risk of human error

You may require automated reconciliation for transaction volumes or for financial disbursements, or both. What matters is that the tool you use helps you get to the correct figures within the required timeframes. Using a reconciliation tool that can calculate settlement amounts automatically will mean your team would only need to audit the results instead of calculating them manually, addressing the risk of human error mentioned earlier.

5. Flexibility enabling customised reporting

Every business’s needs are unique. This is why it’s beneficial to use an automated reconciliation tool that enables you to filter certain fields when looking at reconciliation results - such as transaction statuses/outcomes, amounts, or processing dates. Having flexibility in this regard gives your team the ability to use only the information they require on any given transaction - helping them to make informed decisions when resolving unmatched transactions and exceptions.

The reconciliation process is one that needs to be accurate, dependable, and able to keep up with volume changes when they happen. You can gain access to Electrum’s Finance tool for automated reconciliation by partnering with Electrum for your high-volume VAS portfolio.

Chat to us about growing your VAS portfolio, and gaining access to a tried and tested automated reconciliation tool.

Electrum Software

Electrum is the next-generation payments software company, powering payments for banks and retailers. Since 2012, we have established ourselves as a respected software partner through our deep expertise and track record in delivering trusted cloud-native payments solutions.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape