Semi-automated reconciliation processes are essential to major retailers – not only do they put an end to manual, labour-intensive processes, but they have the potential to save your business money. Let’s unpack what you can do to ensure an effective end-to-end reconciliation process.

In these times of increasing electronic tender and selling of digital goods and services, the settlement of value usually occurs after the event has taken place, despite real-time communication between all parties involved. This could leave you out of pocket due to an electronic payment tender from your bank, or you'll owe third parties for the digital goods and services you have dispensed. Regardless of which case it is, understanding the flow of funds, along with the processes that underpin these, is an essential component to your financial process. Embracing and implementing end-to-end reconciliation is the first step your business should take to ensure accurate financial accounting takes place.

What is end-to-end reconciliation?

Reconciliation is a step in the finance process that involves comparing two or more sets of records to see if they match up, and to manage the resulting exceptions. This ensures that financial records are correctly recorded and that all amounts are accounted for.

End-to-end reconciliation involves analysing and comparing transaction records all the way from the point of origin – which for most retailers is the point of sale (POS) – to the third party provider involved in that transaction. This provides the safest and most accurate view of what really took place, along with information on the financial obligations that exist between the parties.

It is necessary to reconcile individual points of difference in order to diagnose issues where transaction totals don’t match up, and to take appropriate actions to resolve this between parties. This process, if performed manually, is painstaking and time consuming for accountants to perform and requires certain levels of automation in order to be done effectively and efficiently.

Why you need efficient and semi-automated end-to-end reconciliation

1. To inform the five assertions related to financial statements

-

Existence or occurrence: Can we prove that a transaction took place?

-

Completeness: Do we have a record of all the transactions that took place?

-

Rights and obligations: Do we have an accurate view of all the transactions we performed, and do we understand our obligations to third parties?

-

Accuracy or allocation: Do we have an effective and efficient process to diagnose the correct version of what took place?

-

Presentation and disclosure: Can we accurately and efficiently present a consolidated view of what took place between two parties?

2. To reduce accounting errors

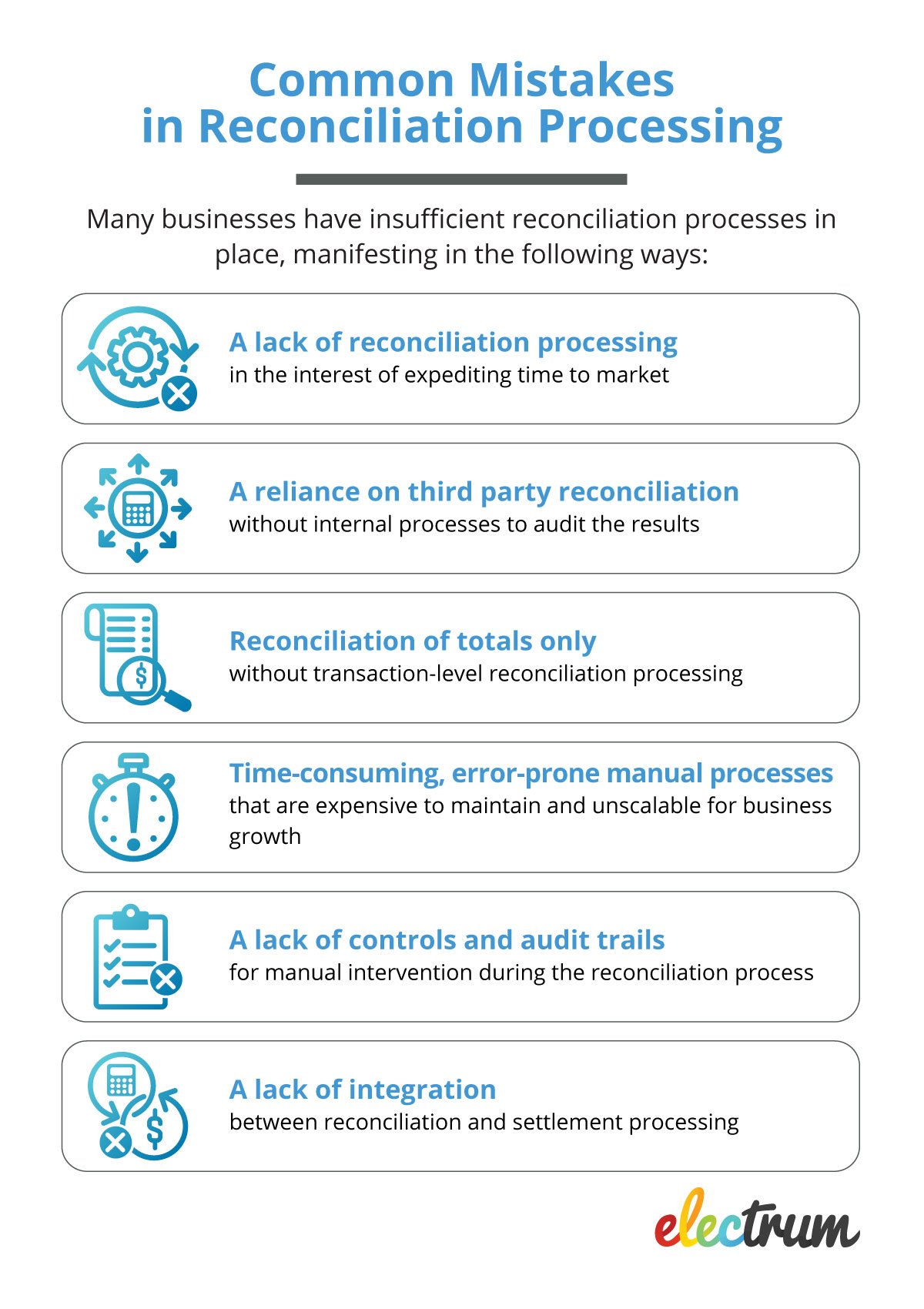

Even the best and most experienced accounting professionals make mistakes, particularly when complex and high volume manual processing is required. As your business scales, and you add more digital products and services to your portfolio, the burden on your finance team will grow and mistakes will become more commonplace.

With a rock-solid, end-to-end reconciliation and exception management process in place, issues can be identified and resolved proactively - reducing the need for manual corrections to be made.

3. To ensure inflows and outflows are managed concurrently

As a retailer, you're collecting payments and paying third party suppliers at the same time. Errors in what you owe and what you are owed can have a significant impact on your cash flow, putting your business at unnecessary risk. This cash flow risk can be mitigated through a semi-automated process that eliminates these sorts of errors.

4. To enable your finance team to scale with your business demands

Onboarding new products and service providers is complex due to the technical requirements of integration and transaction processing. Onboarding is often further delayed by the inability of the retailer's finance departments to respond quickly enough. With the right tools and processes in place, this business obstacle can be significantly reduced or even removed altogether.

5. To save your business money

A lack of reconciliation processing can result in errors going undetected. In some cases, this can even result in financial losses. Ensuring that what happened at the POS is correctly reflected at the bank, or with your third party supplier, is essential to ensuring you're not short-changed due to processing errors or irregularities.

6. To help identify fraud

Whilst some inconsistencies are caused by system errors, retailers are equally at risk when their businesses are a target of fraudulent activities. Without end-to-end reconciliation processing in place, it is easy to miss these anomalies, whereas detecting them with the necessary processes in place is simple.

Electrum's solution offers overlay toolsets for back office processes, transaction visibility, risk mitigation, and improved reporting. Get in touch if you would like to chat more about how our solution can improve your business processes.

Electrum Software

Electrum is the next-generation payments software company, powering payments for banks and retailers. Since 2012, we have established ourselves as a respected software partner through our deep expertise and track record in delivering trusted cloud-native payments solutions.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape