While the first phase of the Rapid Payments Programme only involves banks, it won’t be long before non-bank entities can experience the benefits of the high-volume, low-value real-time payments system. Here, we take a look at potential benefits merchants can look forward to as RPP rolls out in South Africa.

Change is coming for the South African payments landscape, with the Rapid Payments Programme beginning its rollout. With the goal of making real-time payments cheaper and more efficient, the programme is expected to revolutionise consumers’ transacting experience.

Currently, the focus is on banks building features that support RPP into their existing core systems. These include real-time credit push and pay-by-proxy functionalities. As the programme is rolled out, additional features will be developed to continue driving it forward.

As has been seen in other countries around the world where instant payments have taken off, such as India, Thailand and Singapore, it won’t be long before non-banks – including merchants – can get involved and benefit from the new payments system. While regulatory details are still being confirmed about what the next phase of RPP will look like in South Africa, international experience can give us some idea as to what benefits local merchants can expect.

Simpler, cheaper, more streamlined payments

Since its inception in 2016, India’s Unified Payments Interface (UPI) has become more and more ubiquitous, quickly becoming consumers’ go-to platform for retail digital payments. In October 2021 alone, a whopping 4.2 billion transactions were processed.

An effective real-time payments solution has allowed merchants to revolutionise consumers' transaction experience through a cheaper-to-run, modernised acceptance solution.

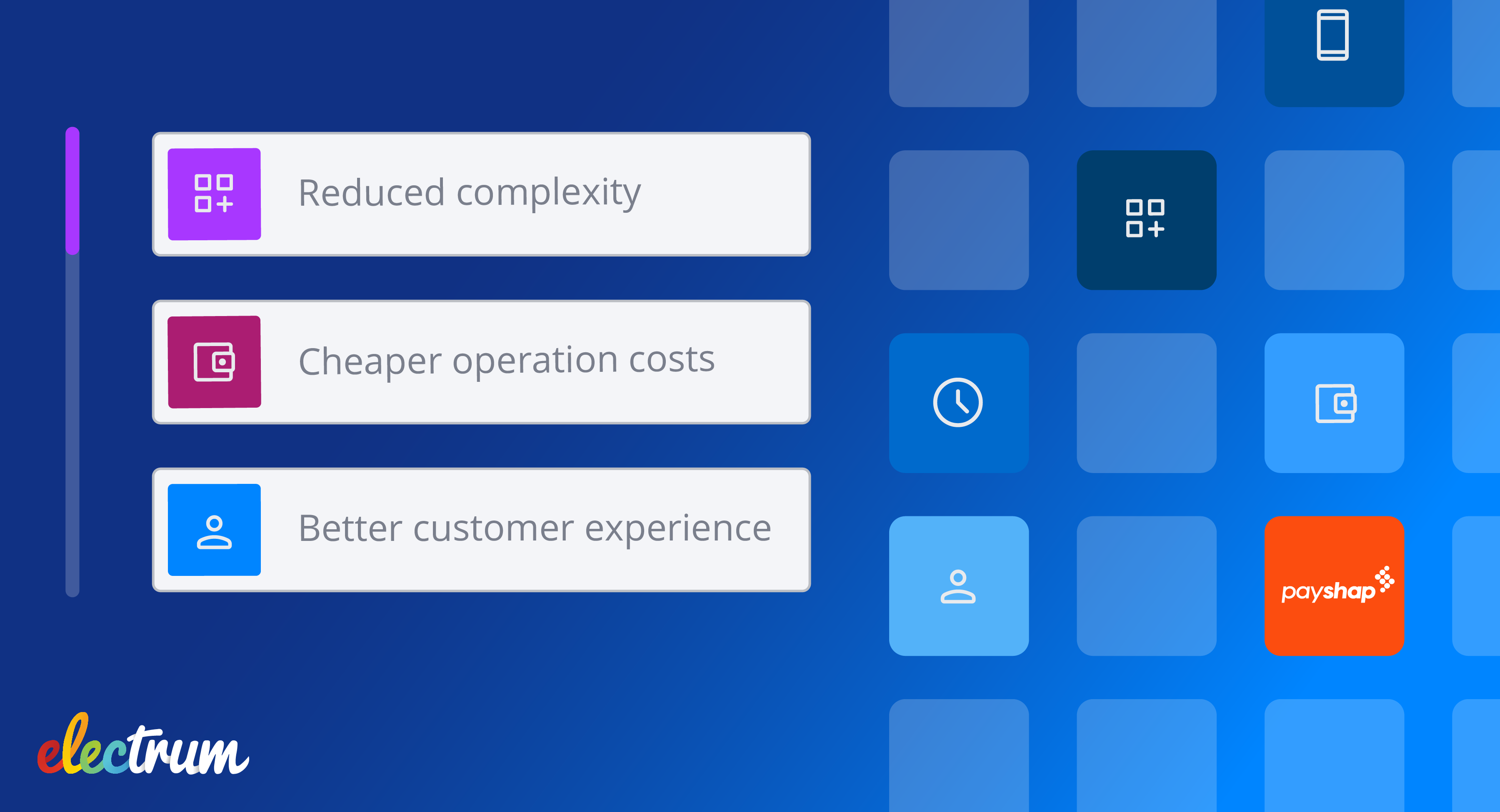

Looking at overseas examples like this, it’s likely that the Rapid Payments Programme will bring with it the following benefits for South African merchants:

- Reduced complexity: One of RPP’s primary goals is to make transacting easier for all parties involved. For merchants, the drive to simplify payment processes will eliminate the “last-inch problem”, with easy-to-use interoperable solutions, like QR codes, replacing complex, expensive acceptance infrastructure. Cash will also be displaced, which removes associated costs and risks.

- Cheaper operation costs: While costs haven’t been confirmed yet, it is highly likely that running and accepting payments through a real-time payments system will be significantly cheaper than interchange fees associated with card payments. This will benefit both SMEs who don’t have as much bargaining power as multi-lane retailers do when it comes to merchant discount rates and bigger enterprises that can save millions from even slightly cheaper fees.

- Better customer experience: As RPP becomes more prevalent, merchants will be able to offer consumers a more seamless payment experience. With little more than a bank account and a mobile phone required to initiate real-time payments, consumers can perform every action required to make a purchase from the palm of their hand. Making transactions easy for consumers will ensure stickiness.

If you’re interested in chatting more with our team about where the Rapid Payments Programme is currently at in South Africa and how Electrum can help your business get on board, please reach out to us here!

Kyle Hoffman-Barrett

Kyle is Electrum’s Technical Solutions Consultant. His natural interest in problem solving and technology have made him passionate about finding innovative solutions to real-world problems.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape