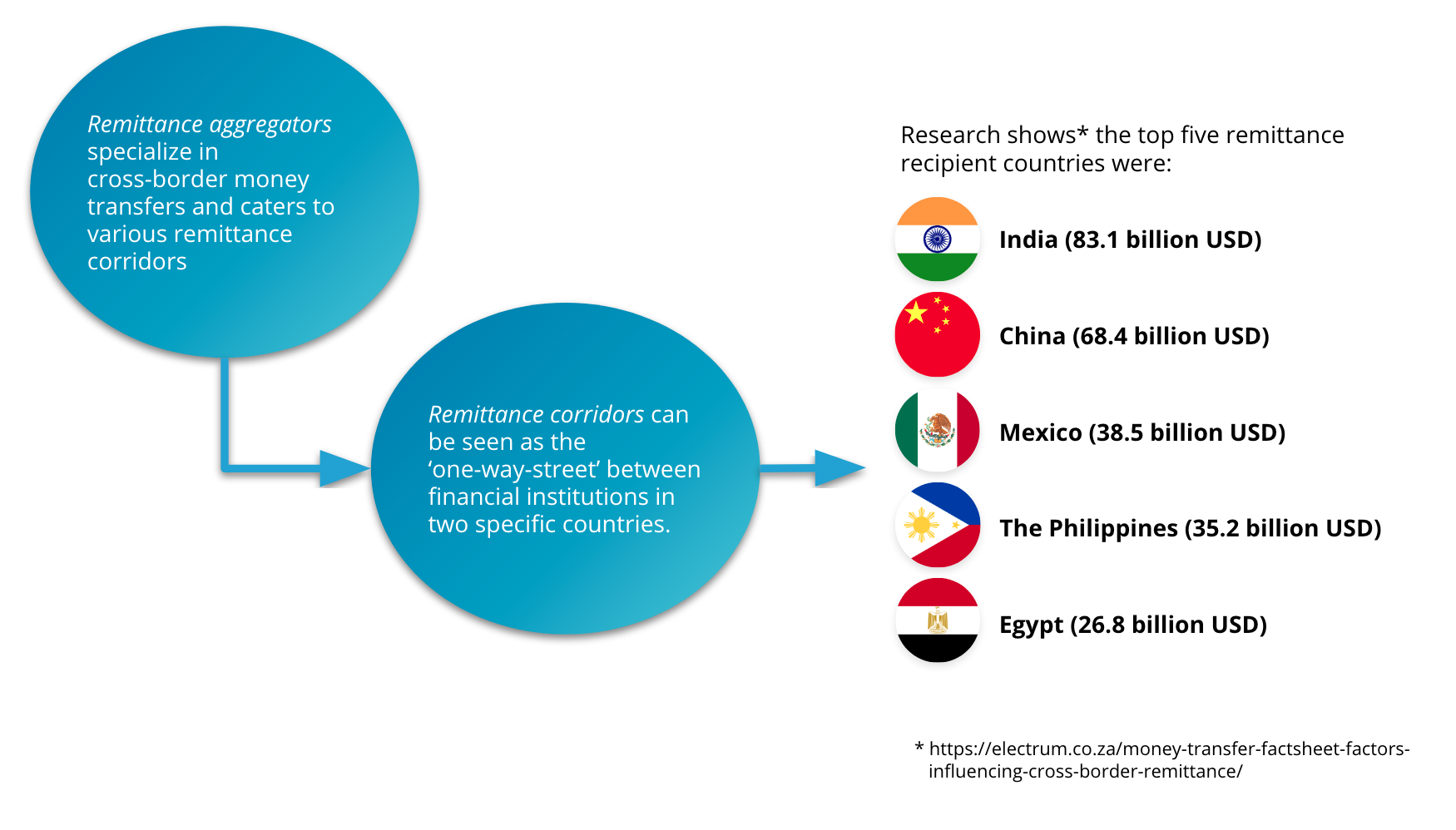

In 2018, the global remittance market size was valued at $682 billion. According to industry research, it is projected to reach $930 billion by 2026, growing at a compound annual growth rate (CAGR) of 3.9%.¹ If you’re wondering how you can gain a share in this rapidly-growing market, the answer is easy -build an efficient network of partners. Integrate your business into more aggregators for access to multiple corridors, allowing you to process more remittances.

Integrating your remittance business to multiple aggregators comes with clear benefits, along with factors that could pose difficulties to the process. We explore these opportunities and challenges in the table below.

Partnering with Multiple Aggregators: Benefits and Challenges

Higher commission from lower fees

Different aggregators have separate agreements with individual corridors which in return leads to varying costs for your business. Make more money by integrating into multiple aggregators that support the same corridors. This will ensure higher commissions from lower fees.

Commercial agreements

Factors such as local policies, regulations, time zones and languages can all prolong the process of closing commercial agreements.

High degree of redundancy

Money transfer services can sometimes be unreliable, but having agreements with multiple aggregators builds a high degree of stability. If one aggregator has a problem with a specific corridor, the integration into another aggregator can keep your money transfer service running / “always on” within that corridor.

International system integrations

Even after a commercial agreement is made it can still be challenging to complete a quick and easy integration into various different aggregators. This is due to differing systems across involved entities, with the potential of a lack of support due to factors such as language barriers. The understanding of the tech in play may also vary across borders.

Wider cash-out reach

Not all aggregators support all three bank, mobile wallet and cash corridor types. The more aggregators you integrate to, the wider the cash-out footprint you create, giving your end-users more flexibility.

Restricted compliance measures

Remittance providers demand valid identity documents from customers to comply with regulatory guidelines. With digital remittances on the rise, the compliance landscape is changing to such an extent that the physical presence of the customer is becoming irrelevant. New compliance measures include biometrics, facial recognition, and voice recognition and can change from aggregator to aggregator. This leads to different measures of compliance across remittance corridors.

Electrum offers quick and easy access to multiple aggregators through one API, allowing you to efficiently build your remittance offering. Chat to our team to utilise our established network for local and international remittances.

¹ https://www.alliedmarketresearch.com/remittance-market

Liezl Basson

Liezl joined Electrum’s Marketing team in 2020 from a (hard lockdown) Zoom screen. Nowadays, if she’s not in her sunny corner in the office researching everything about VAS, she’s probably strolling, coffee in hand on the Sea Point promenade.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape