While paper-based vouchers have existed for decades, digital vouchers have emerged as noteworthy contenders in South Africa’s digital goods and services marketplace. This blog highlights the different types of digital vouchers that are available, as well as the opportunities that offering these vouchers presents for your business.

Maybe digital vouchers are outpaced by more popular value-added services (VAS) offerings, such as prepaid airtime and data, bill payments, and prepaid electricity, but their impact and potential in a consumer-driven environment should not be underestimated. Digital vouchers appeared as a notable product in the 2022 Digital Goods and Services Report, with research showing that consumers anticipated purchasing more of them in the future. Coupled with this, most survey respondents said they bought vouchers monthly, which shows that vouchers are a regular purchase.

Vouchers have proven to be a reliable alternative to cash. They enable consumers to instantly switch from using cash to making digital payments for goods and services. Consumers can also purchase and share vouchers with other consumers (e.g., retail, food relief, and medical vouchers). A voucher experience is two-fold: being able to provision a voucher and supporting the redemption of a voucher. Providing one or both aspects of a convenient voucher experience makes businesses more relevant, and encourages loyalty from consumers.

Understanding the digital vouchers landscape

According to the 2022 Digital Goods and Services Report, the most popular goods and services vouchers are purchased for streaming, gifting, app store transactions, retail and payment, and discounts. The Report also states that most consumers prefer to buy vouchers from their bank apps or in-store from a retailer, either at a till point or money market counter (illustrated in the graph below).

New vouchers are constantly being introduced to the market, bringing with them opportunities for expansion. While vouchers started out as a payment method for specific purchases, they have evolved to cater to consumers requiring different products or services.

Single-purpose vouchers limit consumers to buying specific items from specific online or retail vendors - meaning the voucher’s use is limited. Whereas, universal vouchers can be redeemed from various online or retail vendors.

For example:

Let’s say a consumer buys a single-purpose voucher from a vendor for Steers fast food. The consumer won’t be able to redeem the voucher at another fast-food outlet, like Spur, Nando's, or Burger King. They would be limited to redeeming the voucher for food at a Steers outlet.

Now, imagine that a consumer buys a universal 1ForYou voucher. They can send this voucher to family or friends without specifying what the voucher is for. The end user can then redeem the voucher for a variety of products and services, including fibre, utilities, shopping, entertainment, travel, healthcare, insurance, and more. This gives both the buyer and the end user flexibility - from being able to purchase vouchers from a variety of vendors, to being able to redeem vouchers with just as much variety.

Who’s who in the vouchers market

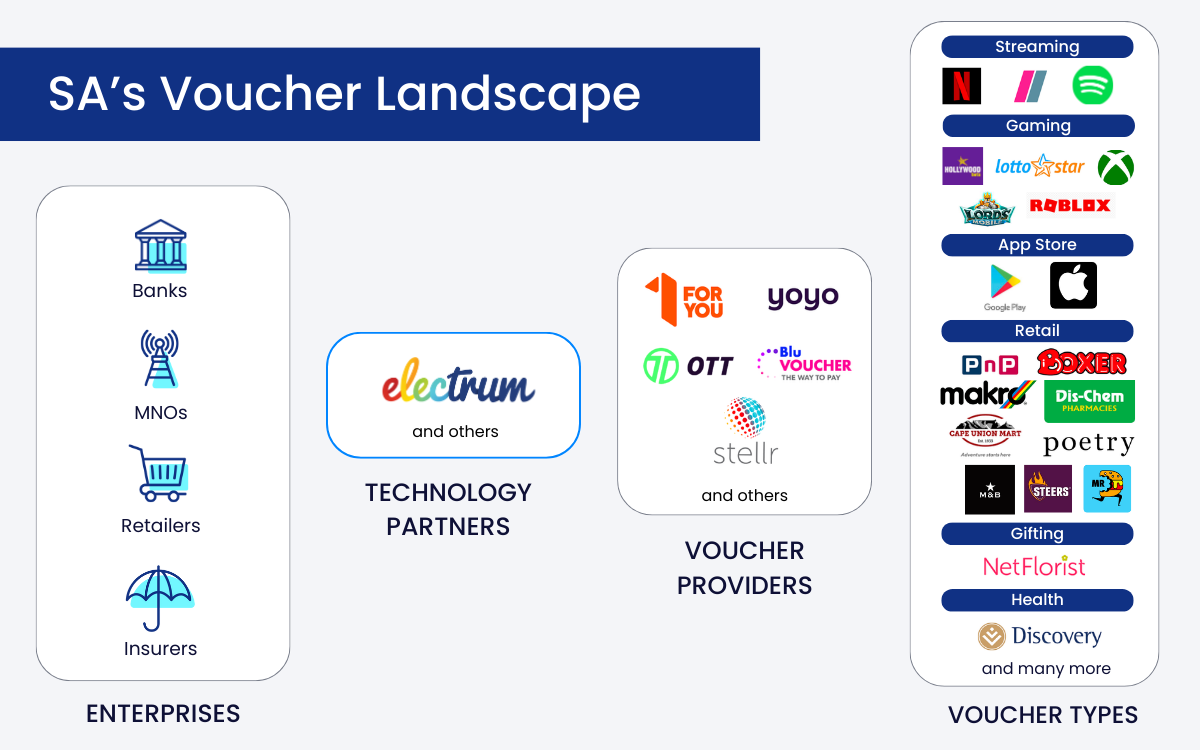

These are the key players in the market, and the roles they play in providing consumers with a vast range of vouchers:

Enterprises

Banks, retailers, insurers, and MNOs enter into commercial agreements and integrate with providers to offer an array of vouchers. One of the factors affecting the revenue margins on these commercial agreements is access to limited providers.

Technology partners

The vouchers market is continuously evolving, presenting the need to work with a technology partner to keep offerings up to date. By partnering with technology experts, such as Electrum, enterprises are guaranteed a robust Vouchers service. One that ensures scalability and the ability to get new services to market quickly, while handling provider intricacies, to meet new consumer demands.

Voucher providers

These are wholesale providers and aggregators that provide access to massive voucher portfolios at competitive prices. By integrating with one or more providers, vendors can grow their own digital voucher offerings, staying up to date as providers add more vouchers to their portfolios.

Voucher-related opportunities

There are ample opportunities for enterprises looking to introduce or expand their voucher offerings. The key is to understand what drives the use of vouchers, and what they are used for in the market.

-

Convenience is a major driver of modern economic activity. Consumers are more likely to purchase goods and services that they can easily access, which is partly where the voucher opportunity lies. By offering a seamless voucher experience, you stand to gain new customers and keep existing ones as your service will provide the convenience they expect.

-

Vouchers promote financial inclusion for consumers who don’t have bank accounts or other means of cashless transactions. This is especially true for the underbanked and unbanked, as vouchers enable them to access online services, such as streaming platforms. In a country like South Africa, where many migrant workers support their families back home, vouchers are a safe way to help loved ones pay for goods and services. They reduce the risk of carrying the cash while allowing consumers to safely transfer value where it’s most needed.

Beyond South Africa’s borders

The voucher landscape can also be influenced by what is happening across the continent. By looking to the rest of Africa, we can find reference points when identifying new voucher potential to unlock in the future. Here are a few examples of digital vouchers cementing their space in other African countries: Zambia’s government-backed digital voucher system for farmers; Orange Morocco’s focus on gaming vouchers; and the availability of meal, gift, entertainment, travel, and grocery vouchers in Uganda and Kenya.

-

Last but not least, gaming vouchers, which include sports betting, have seen significant uptake since the COVID-19 pandemic. The growth of this kind of entertainment proves that providing consumers with the vouchers they want, digitally, is key to building a relevant, successful VAS offering.

Building a successful voucher offering takes a forward-thinking approach, having a handle on the market, and having the right partners in your corner. With this combination of knowledge and skill, the opportunities are endless.

Electrum’s Digital Goods and Services Platform enables integrations with a multitude of reliable voucher providers for different types of enterprises. Contact us to expand your VAS portfolio with vouchers.

Electrum Software

Electrum is the next-generation payments software company, powering payments for banks and retailers. Since 2012, we have established ourselves as a respected software partner through our deep expertise and track record in delivering trusted cloud-native payments solutions.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape