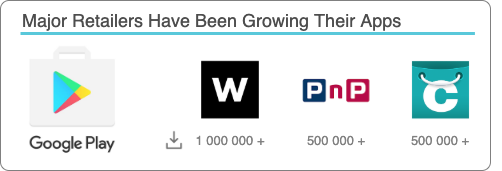

Digital retail sales have been on a huge growth trajectory since lockdown, but they are still tiny when compared to in-store volumes. Increasing digital engagement is seen as an essential growth strategy throughout the industry, and retailers have been working hard to develop their online and app offerings.

In particular, retailer apps are improving, with increased functionality such as online shopping, loyalty, and convenience features being added to the digital experience. Despite all the effort, driving engagement and retention remains a constant challenge.

In South Africa, where the vast majority of customers still choose to come into the store, how can you create value for customers to keep them coming back to your app? The answer is to provide real value to shoppers when they use your app.

One area that is ready for disruption is the physical gift card. Gift cards are hugely popular, with millions of cards being issued annually. As one of the top ten VAS products purchased by consumers, offering digital gift cards as part of your app will be a big drawcard. This will also help to lower the cost of physical cards and distribution, and reduce the risk of fraud associated with the anonymity of physical cards.

As QR code payments become more popular in South Africa, due to the adoption of this payment type by many leading retailers, the value proposition of bringing gift cards into your app is greater. Imagine the following:

- Using their email and/or mobile number, the sender is able to buy a virtual gift card from within your app.

- On receiving a notification that a virtual gift card has been sent to them, the recipient downloads your app.

- After logging in with the correct validated phone number or email, the voucher is automatically loaded into their app as a payment option.

- When the voucher recipient goes shopping, they use the app to make payment against the voucher value by scanning the QR code on the POS.

Apart from the savings in the production, distribution, and shelf space needed for physical cards, there are many good reasons to go digital. Providing contactless payment options is a must during this coronavirus pandemic, and the business opportunities associated with leveraging closed-loop QR payments shouldn’t be overlooked.

Making use of an app to redeem digital vouchers or digital gift cards means that once the recipient has activated your app to load the voucher, you can maximise customer satisfaction and value by offering complimentary products and services, such as discounts and customised specials. At the same time, you can discourage fraudsters by monitoring gift redemptions with data-rich details.

Not only will moving your gift card offering into your app limit fraudulent activity and save you money, it also removes the anonymity of the recipient and grows your customer base.

If you would like to chat more about how we can help you implement this win-win solution quickly and easily, contact us today.

.jpg)

Dave Glass

Dave Glass is a co-founder of Electrum. He holds a BCom Honours (First Class) in Information Systems from the University of Cape Town and an MSc in Information Systems Management from Trinity College in Dublin. Dave has worked in software development and payments industry since 2003.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape