For any bank, data monetisation is an important part of the business to focus on. It can inform strategic decisions, identify new revenue streams, lead to new products and services, and protect against risks. Six areas of opportunity, and the questions all banks should be asking themselves, are unpacked in more detail below.

1. What data can we find in payments?

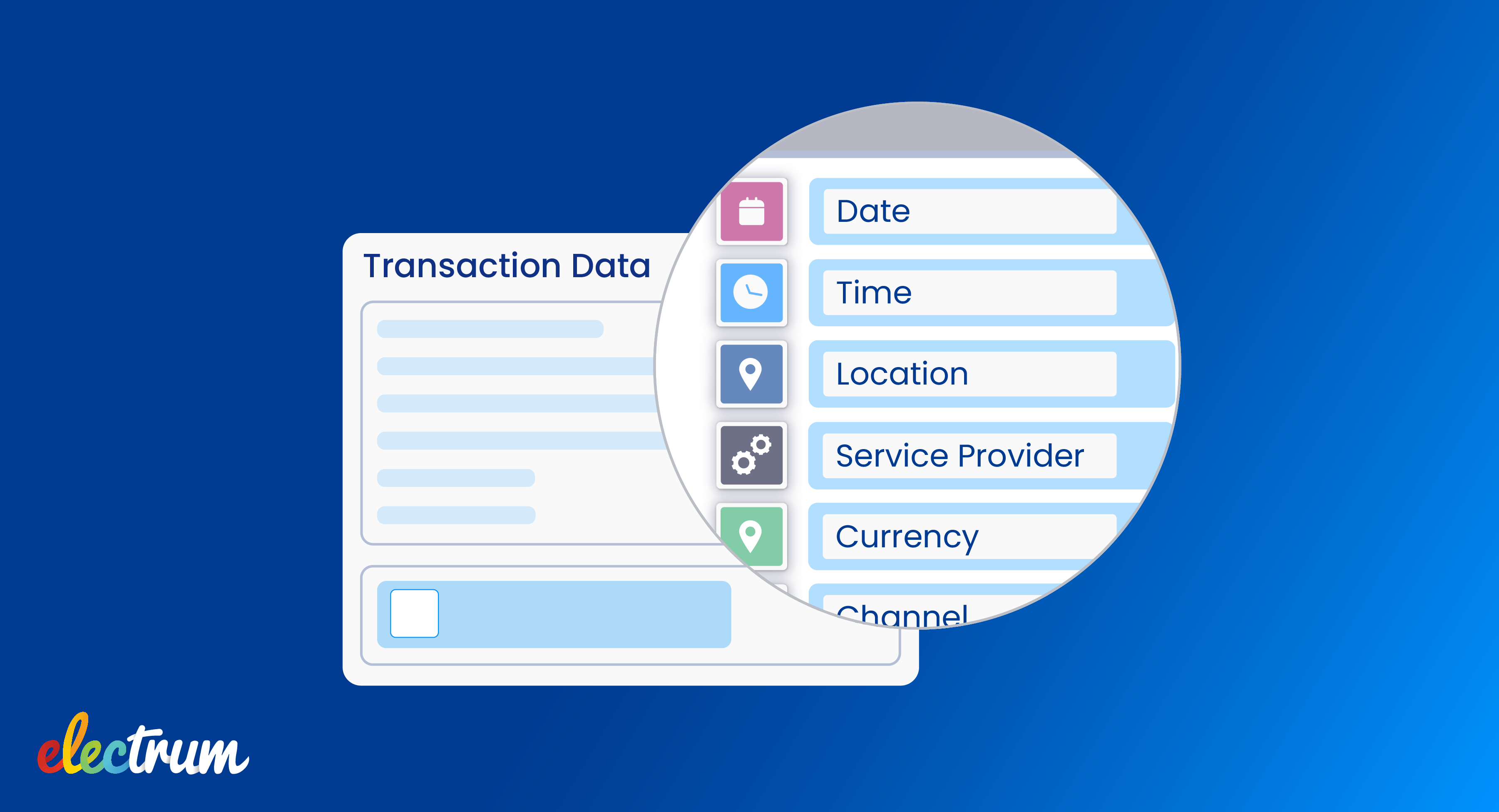

Payment transaction data can provide banks with detailed information on both individual customers and merchant customers. This list is extensive and includes:

- Private Information: Sending and Receiving customer data (Legal Name, MSISDN, identifying information)

- Payer (issuing) Bank, Card IIN, account numbers

- Merchant name, location, category, digital or physical merchant

- Transaction values, currency, date, time, decline reason

- Municipal debt (electricity transactions)

2. What can we infer from this data?

Data such as transaction numbers, amounts, frequency, or patterns all provide insights into your services and your customers. This can assist you in mitigating lending risks for better risk management, for example, the creditworthiness of clients and merchants.

Insights into consumer behaviour can be used to improve customer experience, inform targeted marketing campaigns, help with matching payment channels to customers, and make personalised product recommendations. This data is particularly important when it comes to understanding the consumer adoption of new services.

Merchant and market information and insights can also be inferred - helping you to discover gaps in your offerings, new trends, or market changes.

3. Do we have a siloed view of our data?

Payment schemes are very heterogeneous and it is a significant data engineering exercise to combine payments data without payments modernisation first (e.g., the ISO 20022 standard). That being said, it is extremely valuable for your business to have a combined view of value-added services (VAS) data, payment card data, and clearing house payments data in order to gain a truly holistic picture of a bank’s payment business.

“Huge opportunity exists when you have a complete view of your business - this allows you to identify gaps or improve customer offerings. Having a modernised platform that can enable this single view is going to prove invaluable in this digital banking era.” - Dave Glass

4. Have we considered that data security needs revisiting?

PCI security standards apply to organisations that store, process or transmit cardholder data. This means that there is no ‘PCIDSS’ for account-to-account payments. The main risk in this case is the leaking of personal customer information. There is also a significant risk with devices remembering data and both of these security risks should be reconsidered by banks as you continue on the payments digitisation journey.

5. How can we leverage payments data for fraud prevention?

Since data can be used to pick up unusual patterns in transactions, your data can play a significant role in identifying potential fraud. In this case, having an omni-channel view will provide the most value and most complete usage patterns for fraud detection.

The benefits of having access to real-time dashboards and monitoring become undeniable as your business needs to be reactive and have the ability to act as fast as possible when detecting potential fraud.

6. Have we thought about screen scraping and open banking?

It is important to understand that the South African Reserve Bank (SARB) views the screen scraping of open data as a risk - consumers can see payment providers as a secure portal for making payments but don't realise their open data is being screen scraped and stored.

There is a lack of regulation and security control for third parties, and it is not always clear what is happening to a consumer’s data. Some control is being introduced through the SARB’s Screen Scraping Directive but is this enough to truly keep consumers informed and protected?

Open banking initiatives and the increased use of APIs will enable banks to share data safely and collaborate with third-party providers and fintechs, however, it is not yet understood where the overall responsibility will lie in these initiatives - and banks need to be aware of this.

In conclusion, data monetisation is an area of your bank’s business which should not be overlooked. It provides definite opportunities along with some unknowns as a result of South Africa’s changing payments landscape.

Contact us today to explore how we can help you modernise your payments business.

Helen Whelan

Helen Whelan is a Senior Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape